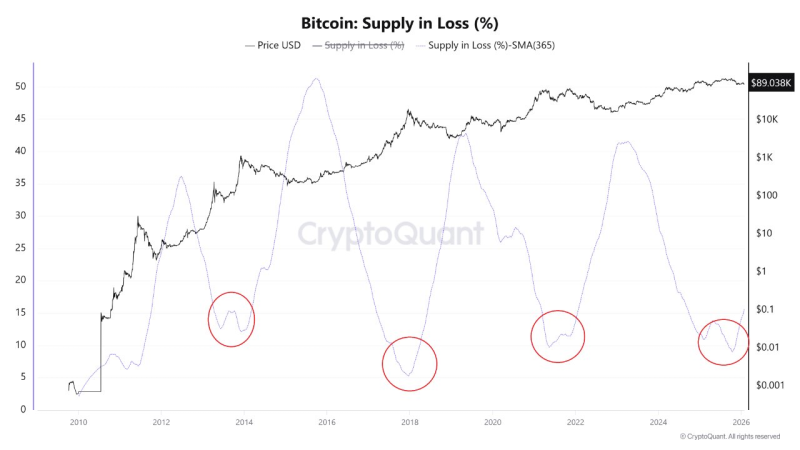

⬤ Bitcoin is showing early warning signs of a potential trend reversal as key on-chain metrics point to growing market stress. Data from CryptoQuant reveals that Bitcoin Supply in Loss (%) has started climbing again, with the current setup mirroring conditions that appeared during previous cycle transitions from bull runs into extended downturns.

⬤ Supply in Loss tracks the percentage of circulating Bitcoin currently held below its purchase price. When this number rises, it means more holders are sitting on unrealized losses as the market weakens. Right now, the increase is still relatively small compared to past bear markets, pointing to early-stage pressure rather than full-blown panic selling. What makes this significant is that losses are beginning to spread beyond quick-flip traders and into longer-term holders.

⬤ Looking back at previous cycles in 2014, 2018, and 2022, Bitcoin Supply in Loss turned upward well before prices hit their final lows. In each case, the market continued dropping after the initial signal, with actual bottoms forming only when losses became widespread across the network. The current reading sits far below peak capitulation levels, but the directional shift itself carries weight. If Bitcoin Supply in Loss keeps expanding, it would strengthen the case for a developing bear market structure with broader implications for sentiment and risk across crypto markets.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah