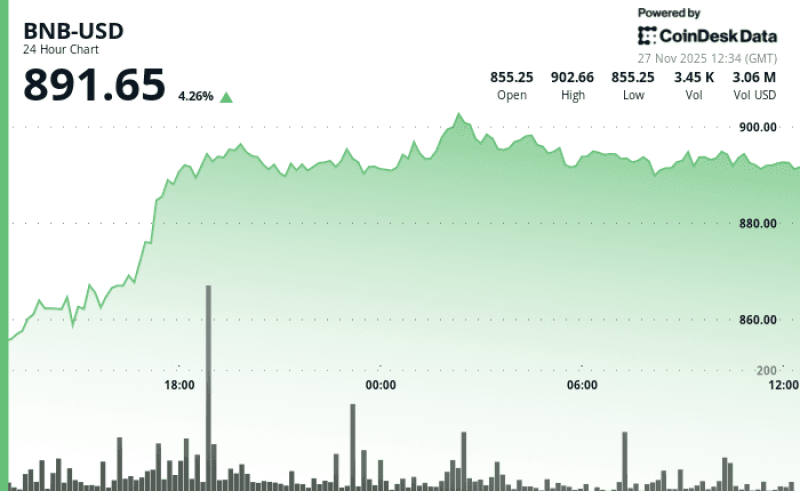

⬤ BNB traded below the $900 mark throughout Thursday and rose only 4.26 % in twenty four hours while network traffic kept falling. The price touched $902.66 for a moment - yet it slipped back plus closed near $891.65 after starting the day at $855.25. Volume reached about $3.06 million, a level that shows steady but modest interest.

⬤ The intraday path shows momentum that faded. The climb from the $855 area topped at $902.66 - sellers returned and drove the price into the upper-$880s but also mid-$890s. The retreat mirrors wider worries about a slowdown on the chain - transaction counts and user interactions have cooled. Buyers remain - yet they lack the force to clear the $900 barrier.

BNB has failed to rise as well as stay above the key level while on chain activity keeps dropping.

⬤ Observers now look toward pending network upgrades that could alter the outlook. Details are scarce, but talk of faster throughput and larger capacity may lift sentiment once concrete news arrives. For the moment traders wait on the sidelines or balance today's low activity against the possible lift from future releases.

⬤ Soft on chain data and the $900 ceiling leave BNB at a decision point. Without a clear trigger, the asset drifts. A clean break above $900 needs two elements - a rebound in user numbers also buying power strong enough to outmatch present selling. Until those conditions line up, BNB is expected to stay in this range.

Peter Smith

Peter Smith

Peter Smith

Peter Smith