Bitcoin (BTC) rallies to $63,500 following an attempted assassination of pro-crypto candidate Donald Trump, reigniting volatility in crypto assets.

Bitcoin Surges to $63K Amid Trump-Related Volatility

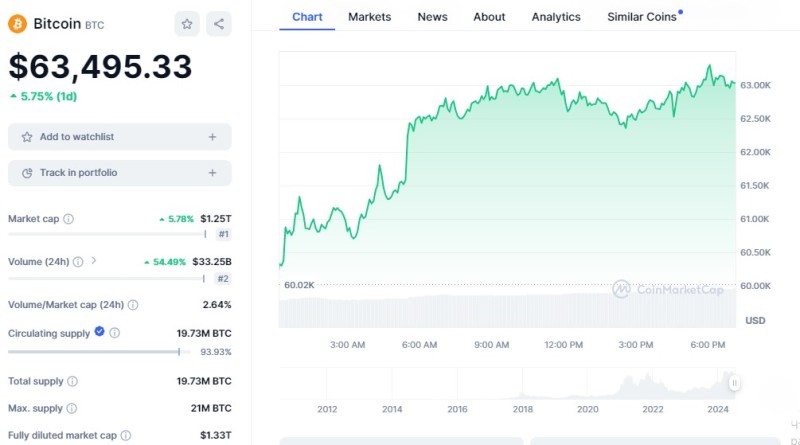

The recent attempt on Donald Trump’s life over the weekend has caused a stir in the crypto market, particularly benefiting Bitcoin (BTC). The leading cryptocurrency saw a significant rally, climbing 7% to reach $63,495. This surge coincides with an increase in Trump’s odds of winning the upcoming November elections, now at 70% according to Polymarket. The pro-crypto stance of Trump has further boosted the momentum for BTC.

Bitcoin's price surge also surpasses the critical 200-day simple moving average (SMA), which is a key indicator for long-term trends. This marks a notable shift in BTC's performance, suggesting a bullish trend. Additionally, Trump-themed Polifi tokens have seen a surge, reflecting the growing intersection between politics and finance. Trump's recent embrace of cryptocurrency to gain an edge over his opponent Joe Biden has made Bitcoin and the broader crypto market pivotal in the race for the presidency.

Crypto Market Reacts to Political Unrest

Greg Magadini, director of derivatives at Amberdata, highlighted the impact of the weekend's events, stating, "The biggest fundamental news over the weekend was the Trump assassination attempt. Absolutely insane. This has improved the odds of a Trump presidency. Trump being the pro-crypto president should help galvanize the cryptocurrency bids." The market's reaction underscores the heightened sensitivity of crypto assets to political developments.

The attempted assassination has not only influenced the crypto market but also caused ripples across global financial markets. The Chinese yuan (CNY) traded lower against the U.S. dollar, reflecting concerns over potential higher trade tariffs under a Trump presidency. Similarly, the Mexican peso (MXN) weakened due to Trump's historically tense relations with Mexico.

Impact on Treasury Yields and Stock Markets

Futures tied to the 10-year Treasury note experienced a drop, indicating higher yields. A potential Trump victory is expected to lead to increased spending, tax cuts, and higher budget deficits, which could steepen the currently inverted yield curve. This steepening historically signals broad-based risk aversion in financial markets. Meanwhile, S&P 500 futures traded 0.18% higher, pointing to a positive opening on Monday despite disappointing economic growth figures from China affecting Asian stocks.

The dollar index, which measures the greenback's value against major fiat currencies, traded 0.10% higher at 104.19, according to TradingView. This uptick reflects the market's cautious optimism amidst the geopolitical uncertainties stirred by the weekend's events.

Conclusion

As the crypto market navigates the aftermath of the attempted assassination and its political implications, Bitcoin’s surge to $63,495 highlights the asset’s sensitivity to such high-stakes developments. Investors remain watchful of the evolving political landscape and its potential impacts on the broader financial markets.

Usman Salis

Usman Salis

Usman Salis

Usman Salis