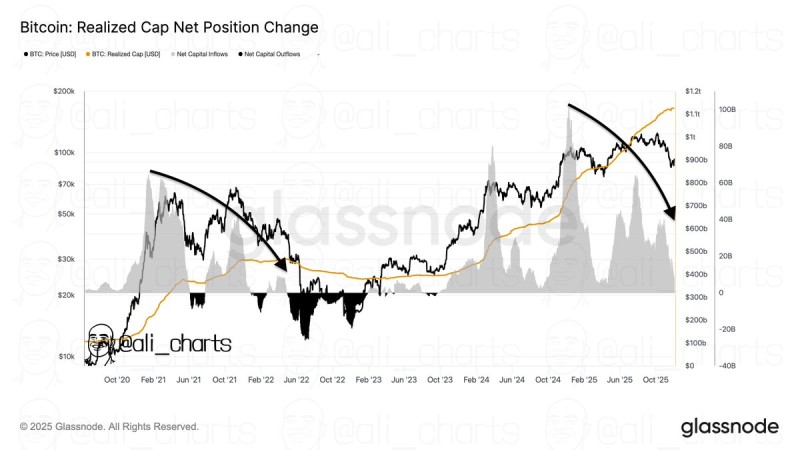

⬤ Bitcoin is showing a growing split between price movement and actual capital flowing into the network. The latest data shows capital inflows into Bitcoin continue to drop and form lower highs even as BTC extends its rally. This trend is visible in the realized cap net position change, which keeps weakening despite spot price strength—drawing clear parallels to the setup that developed before the 2021–2022 macro downturn.

⬤ The data reveals how periods of rising BTC price have come with shrinking realized cap inflows. The inflow waves gradually contract, signaling that long-term holders and larger players are slowing their accumulation. In the earlier 2021–2022 cycle, the same dynamic played out as price climbed, eventually giving way to intensified outflows and a sustained decline. This pattern matters because it shows the underlying capital base supporting the price advance is losing steam, creating a potential structural weakness.

⬤ The repeated formation of lower highs in realized cap inflows, set against higher highs in BTC price, captures the core of this bearish divergence. The analysis also reflects expanding net outflow zones during later stages of the uptrend, similar to what happened before the previous macro downturn. While the realized cap line continues its long-term upward slope, its pace looks more gradual compared to earlier expansions—reinforcing the view that incoming capital isn't keeping up with price appreciation. This setup often leads to reduced resilience during market stress and can influence how quickly sentiment shifts once volatility picks up.

⬤ This development carries real implications for BTC because divergence between price and capital inflows has historically lined up with transitions toward slower trends or corrective phases. If inflows keep weakening, the current upward structure may face pressure, becoming more sensitive to shifts in demand or liquidity. On the flip side, a recovery in realized cap inflows would signal renewed support. With Bitcoin now displaying a familiar divergence pattern, the question is whether the market can sustain momentum or whether this setup evolves into another macro downtrend.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov