Bitcoin is closing in on one of its most dependable on-chain inflection points. Over the last two years, every significant BTC rally has started when short-term holders were nursing deep losses—and we're heading back into that zone right now.

The On-Chain Setup

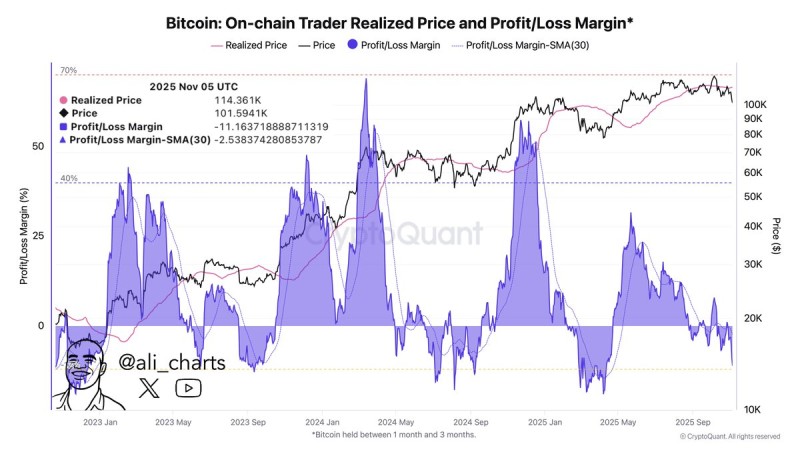

According to fresh data shared by Ali, Bitcoin's Profit/Loss Margin for coins held 1–3 months has dropped to -11%, just a hair away from the historically critical -12% level that's marked cycle bottoms multiple times. With BTC trading around $101,600 while its realized price sits near $114,300, the market is flashing classic undervaluation signals that have previously drawn in buyers.

The CryptoQuant chart tells a compelling story through one key pattern:

- Every time the Profit/Loss Margin hit -12% or lower, Bitcoin bottomed shortly after — this happened in March–June 2023, late 2023/early 2024, mid-2024, and January 2025, each time triggering strong rebounds

- BTC is currently trading below its realized price (~$114K), a condition that's only occurred during major pullbacks and has consistently led to accumulation and reversals

- The current reading sits at -11.16%, with the 30-day average at -2.53%, showing sustained selling pressure that typically signals capitulation among short-term holders

Deep realized losses like these often mark seller exhaustion rather than the start of a larger decline. When short-term holders are underwater and giving up, that's historically been the moment when long-term buyers step in.

What's Driving the Pressure?

A few factors are weighing on Bitcoin right now: ETF inflows have slowed, excess leverage in derivatives is unwinding, macro uncertainty around rates and the dollar continues, and profit-taking after Bitcoin's push above $100K left many short-term holders caught in the pullback. But here's the thing—deep losses often signal the end of the selling phase, not the beginning.

If the margin touches -12%, history says a rebound becomes much more likely. Bitcoin could reclaim levels above the realized price around $114K, and volatility may spike during the transition. Medium-term, this looks like the start of an accumulation phase where short-term holders capitulate and long-term holders scoop up supply. Long-term, the broader structure remains bullish—miner flows show no stress, exchange reserves keep dropping, and core on-chain metrics are still strong.

Bitcoin is knocking on the door of the -12% capitulation zone that's marked every major bottom in the past two years. Trading below realized price and with short-term holders deep in the red, the setup looks increasingly ripe for a reversal. If history holds, we may be approaching the point where seller exhaustion meets renewed demand—and that's usually when things get interesting.

Peter Smith

Peter Smith

Peter Smith

Peter Smith