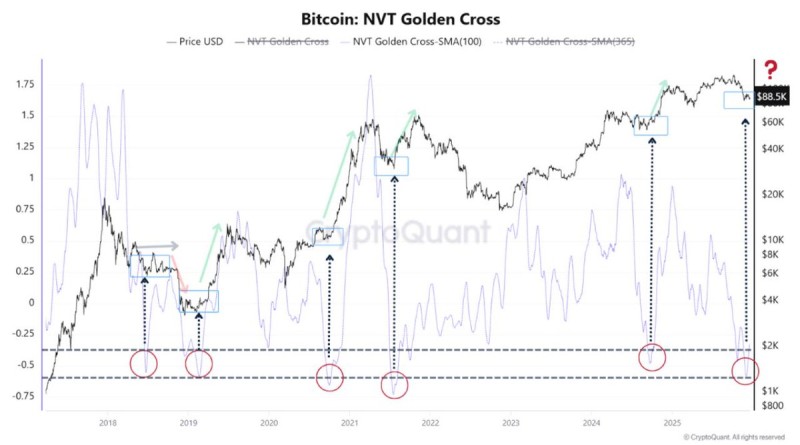

⬤ Bitcoin is showing clear signs of a valuation reset as on-chain data reveals a shift away from deep undervaluation. CryptoQuant data shows Bitcoin moving toward an equilibrium phase based on the Network Value to Transactions (NVT) Golden Cross, a metric that assesses relative valuation using network activity and market cap.

⬤ The chart reveals multiple historical instances where the NVT Golden Cross dropped into deeply negative territory before bouncing back. In past cycles, similar resets happened near major market turning points—often right before strong multi-month rallies. Right now, the indicator is climbing back from undervalued levels while Bitcoin's price remains elevated compared to earlier cycles, pointing to a normalization process rather than a sharp correction.

⬤ The NVT Golden Cross compares Bitcoin's network value with transaction volume using long-term smoothing averages, helping identify whether price is moving faster or slower than on-chain activity. When the indicator rises from extreme lows, it's historically coincided with periods where selling pressure eases and market structure stabilizes. The chart shows this pattern playing out around 2019, 2020, and 2022—each time followed by sustained price gains.

⬤ This matters for the broader market because equilibrium phases typically define the shift between capitulation and renewed accumulation. Bitcoin's ability to move out of undervaluation without breaking down in price shows the market's evolving structure and the growing influence of long-term holders. While the NVT Golden Cross doesn't predict short-term price moves, it's a widely followed framework for understanding where Bitcoin sits within its broader market cycle and valuation range.

Usman Salis

Usman Salis

Usman Salis

Usman Salis