Cardano has entered a volatile phase following a dramatic liquidation event. The daily chart reveals that ADA longs from the November 2024 rally were completely cleared out, forcing leveraged traders to exit.

Price Chart Analysis

According to analyst Deezy, the setup may now be reversing, with liquidity positioning suggesting a possible long squeeze that could "wreck the bears." The daily chart shows a massive wick down as ADA briefly dropped below $0.40 during the liquidation before bouncing back sharply. This classic flush candle cleared out excessive leverage and reset the market structure. ADA is now stabilizing around $0.71–$0.72, showing resilience after the shakeout. Key support sits at $0.60–$0.65 where buyers stepped in to defend price. On the upside, resistance appears at $0.75–$0.80, with a heavier ceiling between $0.90–$1.00. Breaking above these zones would confirm renewed bullish momentum.

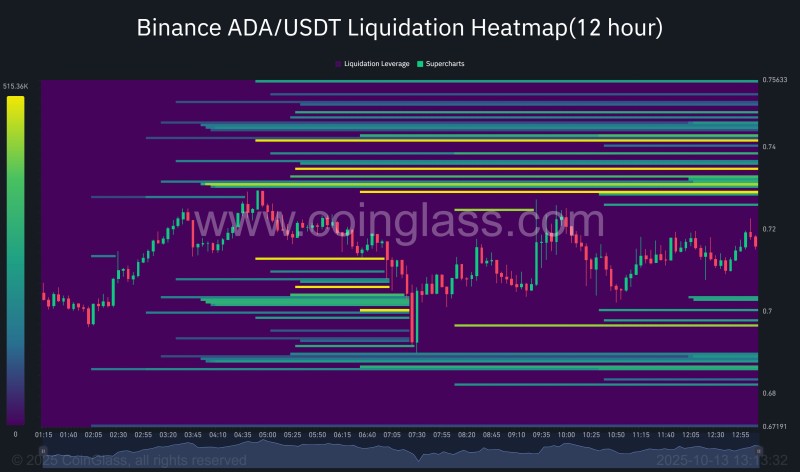

The Binance liquidation heatmap reveals thick liquidity clusters stacked above current price, particularly between $0.72 and $0.75. With longs already wiped out, short positions now dominate the market, creating ideal conditions for a squeeze if ADA pushes higher. A breakout above $0.75 could trigger cascading short liquidations, potentially accelerating the rally toward $0.90 or beyond.

Why a Squeeze Is Likely

Several factors support the squeeze thesis. The recent market-wide washout hit ADA particularly hard, removing weak hands and resetting leverage. After major long liquidations, markets often trap shorts in the subsequent move, a common pattern in crypto. Meanwhile, Cardano's growing DeFi ecosystem and staking activity provide fundamental support that may attract investors back after the reset.

Looking ahead, a bullish scenario unfolds if ADA holds $0.65 support and reclaims the $0.75–$0.80 range, potentially launching toward $0.90–$1.00. However, failure to maintain support could lead to a retest of $0.55–$0.60, though the deep liquidation wick suggests limited near-term downside.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah