Cardano (ADA) is showing encouraging strength as it continues to hold above major moving averages. After a recent dip, ADA has bounced back, suggesting that buyers are regaining control and building a stronger technical base.

Cardano Consolidates With a Bullish Bias

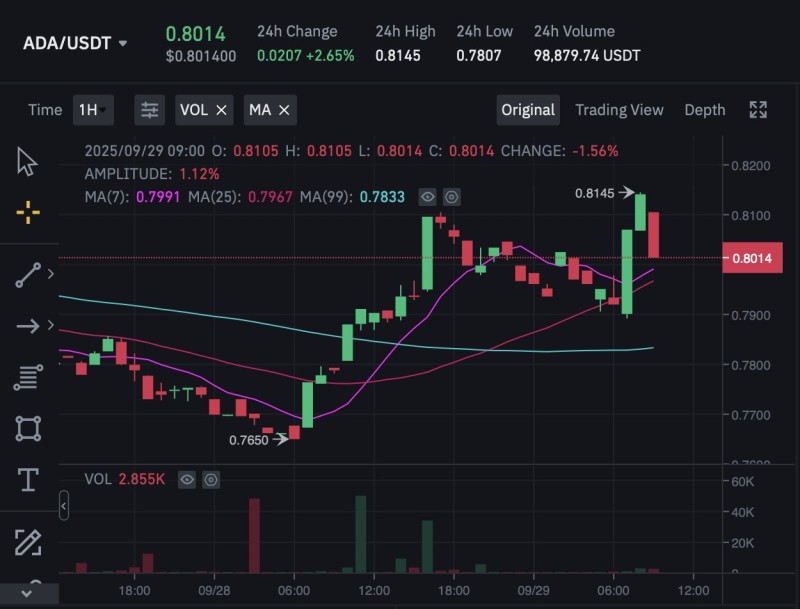

In a recent update, TapTools highlighted that ADA's position above the 7-day, 25-day, and 99-day moving averages underscores a favorable setup across both short- and long-term timeframes, reinforcing the case for cautious optimism among traders.

The chart confirms ADA at $0.8014, backed by the 7-day MA at $0.7991 providing short-term trend support, the 25-day MA at $0.7967 offering a mid-term cushion, and the 99-day MA at $0.7833 serving as a long-term structural base. The alignment of these three averages suggests strong layered support, strengthening bullish conviction.

Price Action and Technical Setup

ADA rebounded from a low of $0.7650, climbing to $0.8145 before consolidating. Green volume bars confirm active buying, while the quick rejection at $0.8145 signals short-term resistance. Higher lows continue to form, keeping the uptrend intact despite pullbacks.

Support sits in the $0.79–$0.80 zone, aligned with short- and mid-term moving averages. Resistance appears at $0.815 as the first hurdle, followed by $0.83 and $0.85. A break below $0.7833 (the 99-day MA) could weaken momentum and shift sentiment bearish.

What's Driving ADA's Strength?

Cardano's DeFi growth and active developer base continue to support adoption, while the broader crypto market recovery has spilled over into altcoins. Trading above long-term moving averages signals stability and encourages gradual accumulation among investors.

What's Next for ADA?

As long as ADA stays above $0.80, buyers appear in control. A breakout above $0.815–$0.85 would open the path toward $0.90 and potentially higher. On the downside, failure to defend $0.7833 could trigger a deeper retracement.

For traders, ADA's current setup emphasizes patience and discipline. With aligned moving averages and steady accumulation, the coin may be laying the groundwork for its next bullish leg.

Usman Salis

Usman Salis

Usman Salis

Usman Salis