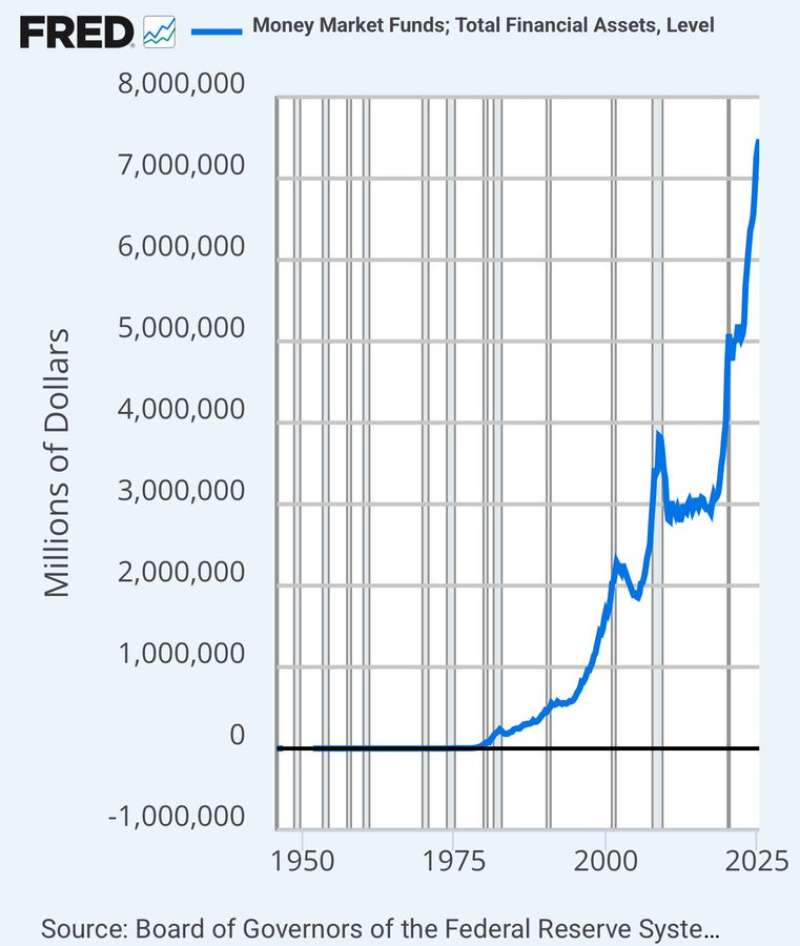

● In a recent analysis, Steph is crypto highlighted data from the Federal Reserve's FRED database showing that assets in U.S. money market funds have climbed to an all-time high of over $7 trillion. This massive accumulation represents capital that's essentially sitting on the bench while investors wait to see what the Federal Reserve does next with interest rates.

● The FRED data reveals an almost straight-up trajectory in money market holdings since 2022. Investors have been flocking to these low-risk vehicles as they chase yields around 5% on short-term Treasuries—a defensive play against both inflation and choppy markets.

● What makes this interesting, according to Steph is crypto, is what happens when the Fed eventually pivots to easier monetary policy. "Over $7 trillion is now sitting in U.S. money market funds. This money will flow into crypto and $XRP soon," the analyst noted, hinting that digital assets could be major beneficiaries when this cash comes off the sidelines.

● History suggests there's something to this theory. When money market balances swell to extreme levels, they've often preceded big rotations into stocks, bonds, or emerging sectors once market conditions and confidence improve. These liquidity buildups have historically marked the starting gun for bull runs across various asset classes.

● The crypto connection remains somewhat speculative at this point. But the math is hard to ignore—even if just a fraction of that $7 trillion shifts toward digital assets, it could meaningfully move the needle on crypto valuations, especially for established tokens like XRP.

● That said, there are plenty of reasons this might not happen quickly. Regulatory headwinds, cautious investor attitudes, and recession fears could all keep this capital parked in money markets longer than crypto enthusiasts hope. For now, what's undeniable is that the financial system is sitting on an unprecedented amount of dry powder—the question is where it goes next.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah