The crypto world is paying attention after a whale with a 100% win rate opened enormous long positions on Bitcoin and Ethereum totaling more than $274 million.

The positions came during a period of sideways trading, raising the obvious question: does this whale see something the rest of us are missing?

The Numbers: $274 Million on the Line

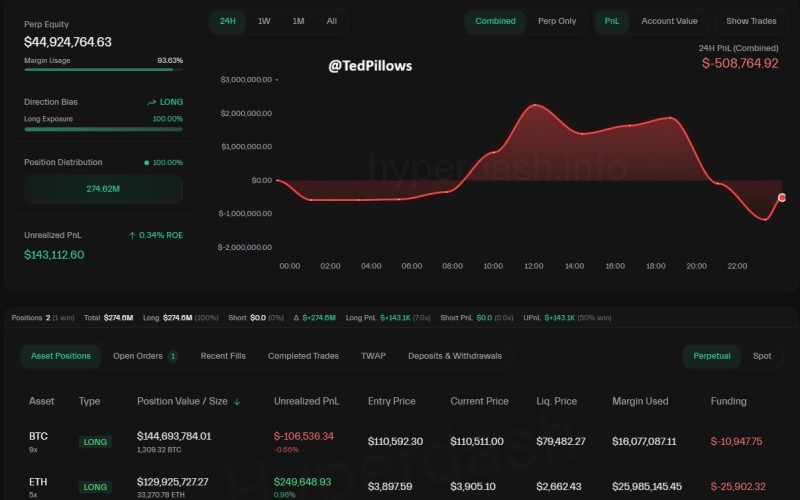

According to data shared by Ted, the trader has gone completely long with no short hedges, using nearly all their available margin—a move that screams confidence in a bullish breakout.

The whale's dashboard tells the story: total perpetual equity of $44.9 million, margin usage at 93.63%, and total long exposure of $274.6 million. They're currently up $143,112 in unrealized profit (0.34% return), though they're down $508,764 over the past 24 hours.

Here's the breakdown: Bitcoin position worth $144.7 million entered at $110,592, currently at $110,511, with 9x leverage. It's slightly underwater at -$106,536 (-0.66%), with liquidation at $79,482. Ethereum position worth $129.9 million entered at $3,897.59, now at $3,905.10, with 5x leverage. This one's profitable at +$249,648 (+0.96%), with liquidation at $2,662.

Despite the daily loss, the whale hasn't budged—they're fully committed to the upside.

The timing is interesting. Both Bitcoin and Ethereum have been trading sideways recently, holding strong despite brief dips. Big players often accumulate during these quiet periods, which historically come right before major breakouts. Several factors could be driving this bet: institutional money flowing into crypto ETFs is building momentum, the macro environment looks friendlier with inflation cooling, and Ethereum's network activity and staking metrics keep improving. The whale's full allocation suggests they believe a bullish turn is imminent.

History Tends to Repeat

Whale accumulation often signals what's coming next. Before Bitcoin's rally in early 2023, on-chain data showed experienced traders loading up on long positions. Within weeks, BTC jumped over 25%. This setup looks similar—high leverage, maxed-out margin, total long conviction. That said, at 93.6% margin usage, there's serious risk here. Any sharp drop could trigger liquidations, especially on the 9x leveraged Bitcoin position.

The tweet went viral fast, injecting optimism into trading circles. When a whale with a perfect track record puts hundreds of millions on the line, it changes the mood. What was neutral sentiment can quickly turn greedy. Retail traders often view these moves as early warnings of trend reversals, especially when the data is transparent like this.

This isn't a small bet—it's a statement. Whether the whale is right or not, $274 million in long exposure demands attention. Markets could be gearing up for a run, or this could be the kind of overconfidence that precedes a sharp correction. Either way, all eyes are on Bitcoin and Ethereum now.

Usman Salis

Usman Salis

Usman Salis

Usman Salis