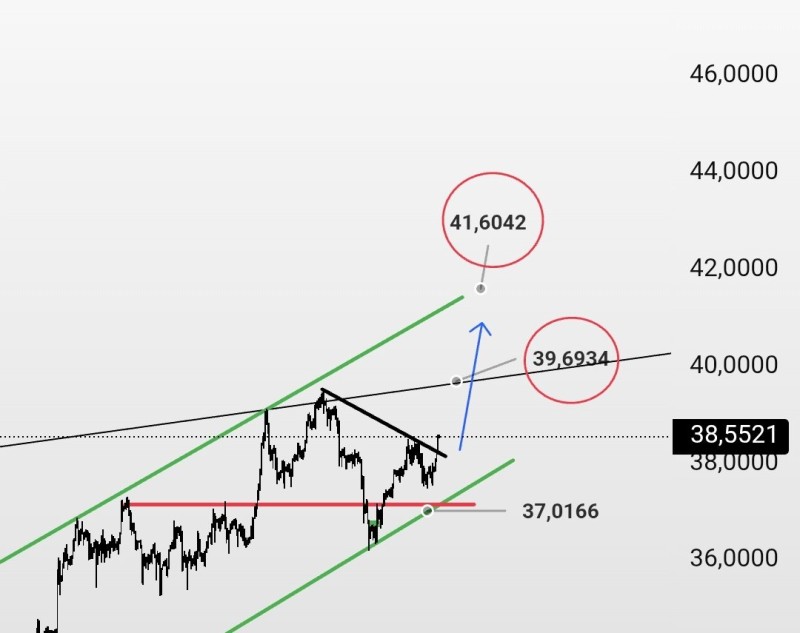

Silver's been on a solid run lately, staying nicely within that green ascending channel we've been tracking. The metal's showing some real strength here, and technical indicators are pointing toward two juicy targets - $39.70 and $41.60.

What's keeping this rally alive? Simple - as long as XAG/USD holds above that black trendline support, bulls are in the driver's seat. The immediate safety net sits at $37.01, which should catch any sudden dips.

XAG/USD Price Action: Bulls vs Bears at Critical Juncture

The chart's telling a pretty clear story right now. Silver's been respecting those green channel boundaries like clockwork, and we're approaching a make-or-break moment at the $39.70 level. This resistance has been a tough nut to crack historically, but the momentum feels different this time.

If buyers can push through $39.70 with conviction, we're likely looking at a quick move toward $41.60. That's where the real test begins - a clean break above that level could open the floodgates for more upside. But if resistance holds firm, don't be surprised to see some sideways grinding or even a pullback to test that $37.01 support zone.

Silver Price Outlook: What Traders Need to Watch

The precious metals space has been getting some love lately, and silver's riding that wave perfectly. The technical setup looks solid - we've got that ascending channel providing structure, decent support levels holding firm, and momentum building toward key resistance.

Here's what matters most: as long as XAG/USD respects this upward channel and doesn't break below that black trendline, the path of least resistance remains higher. Traders are laser-focused on how silver handles the $39.70 test - a breakout there with volume could signal the start of something bigger.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah