⬤ Front-month U.S. natural gas futures have slipped below $3 per million British thermal units for the first time in about four months. Traders are growing more confident that natural gas will stay plentiful despite record exports, and the price drop shows the market is moving away from worries about near-term shortages.

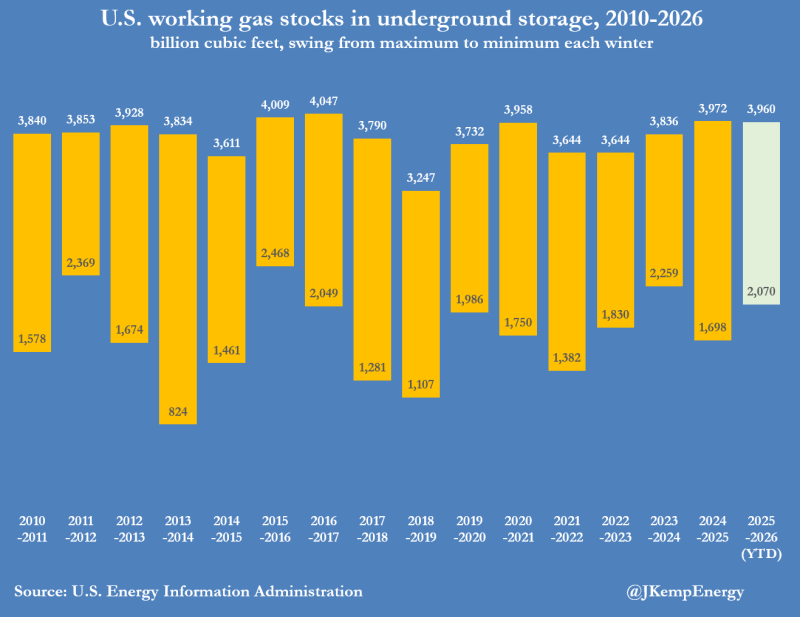

⬤ The decline is happening even though this winter has been the coldest in seven years, going back to the 2018/19 season. Despite the colder weather, inventory levels have only dropped slightly below average, which supports the idea that the market has enough supply. The balance between strong weather-driven demand and solid stock levels is at the heart of the current NG story - the cold hasn't created serious storage stress, and futures prices have adjusted to reflect that.

⬤ Record export flows have been getting a lot of attention because stronger outbound demand can tighten domestic supply when the weather gets harsh. But the combination of only modest inventory drops and current pricing tells us that market players see enough supply to handle demand without a long rally. As one analyst put it, "the cold has not translated into outsized storage stress, and futures pricing has adjusted accordingly."

⬤ Similar price action around the $3 level was covered in Natural Gas Futures Drop to $3 After 56% Collapse from Winter Storm Fern Peak. The main takeaway is that comfortable supply can keep prices from rallying even when factors like exports and cold weather are still in play.

⬤ The move below $3 matters because it shows how fast sentiment can shift when storage doesn't tighten much. Another recent analysis, Natural Gas Tests $3 Support After 8% Drop, highlights how the market sees $3 as a key level for near-term direction. Looking ahead, traders will keep watching whether stocks stay close to average while exports remain high, since that mix will drive volatility through the rest of winter.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah