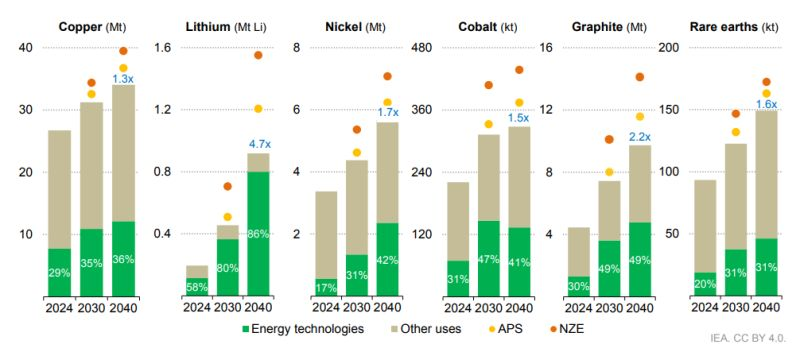

⬤ The metals market is heading into a major growth phase, with copper, lithium, and other critical minerals leading the charge. This isn't your typical boom-and-bust cycle—it's a fundamental shift driven by energy technology expansion worldwide. Fresh projections through 2030 and 2040 show demand climbing across copper, lithium, nickel, cobalt, graphite, and rare earth elements, with clean energy applications taking up more and more of total use.

⬤ Copper sits at the heart of this transformation. It's everywhere in the modern economy—power grids, solar and wind farms, electric vehicles, charging infrastructure. The data shows steady demand growth toward 2040, with energy tech grabbing a bigger slice of the pie each year. Sure, copper isn't growing as fast percentage-wise as some battery metals, but when you're starting from such a massive base, even small percentage jumps translate into huge volumes.

⬤ Lithium is the real standout here. Demand is expected to multiply several times over by 2040, almost entirely because of EV batteries and grid-scale storage. As one analyst noted, "We're looking at demand growth of 1.5x to more than 2x across multiple critical minerals by 2040—clean energy is completely reshaping how we consume these materials." Nickel, cobalt, graphite, and rare earths are following similar patterns, with energy applications becoming the dominant driver.

⬤ Here's why this matters: supply can't keep up. Mining projects take years to develop, permitting is a nightmare in most jurisdictions, and production is heavily concentrated in just a few countries. While demand forecasts keep climbing, new supply isn't coming online fast enough. That gap is going to mean higher costs, scrambles to secure supply chains, and volatility in commodity markets for years to come.

Peter Smith

Peter Smith

Peter Smith

Peter Smith