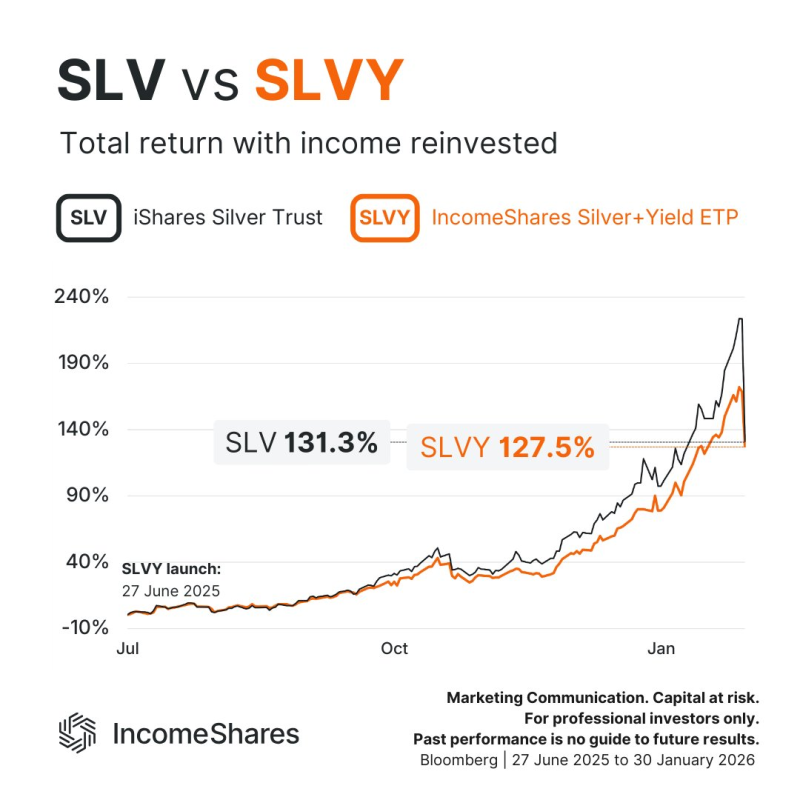

⬤ Silver got wild at the end of January, so it's worth checking how different silver products actually handled the swings. The chart tracks total returns with income reinvested for both iShares Silver Trust (SLV) and IncomeShares Silver+ Yield ETP (SLVY). What you see is how strategy design changed results when the market flipped from rally mode to pullback.

⬤ Between SLVY's launch on June 27, 2025 and late January 2026, both funds rode silver's climb higher. When the rally really heated up, SLV pulled ahead and finished with around 131.3% total return. SLVY delivered strong performance too at roughly 127.5%, but trailed slightly. The gap widened as silver accelerated because SLV tracks price movements directly without any options layered on top.

⬤ The real difference showed up when silver tumbled at month's end. SLV dropped harder while SLVY's decline stayed more contained. That's the covered call strategy at work—SLVY holds SLV shares for price exposure but sells call options to collect income. "The income component helped cushion losses during the correction, even though it limited participation during the strongest upside phase," the strategy documentation notes. You give up some upside to soften the downside.

⬤ This matters for anyone trading silver because it shows how product structure affects returns when volatility spikes. The SLV versus SLVY split during both the rally and the drop illustrates the classic trade-off: full upside exposure versus partial downside protection. With silver still swinging hard, understanding how these strategies react helps set realistic expectations around volatility, risk exposure, and what kind of performance you're actually signing up for.

Usman Salis

Usman Salis

Usman Salis

Usman Salis