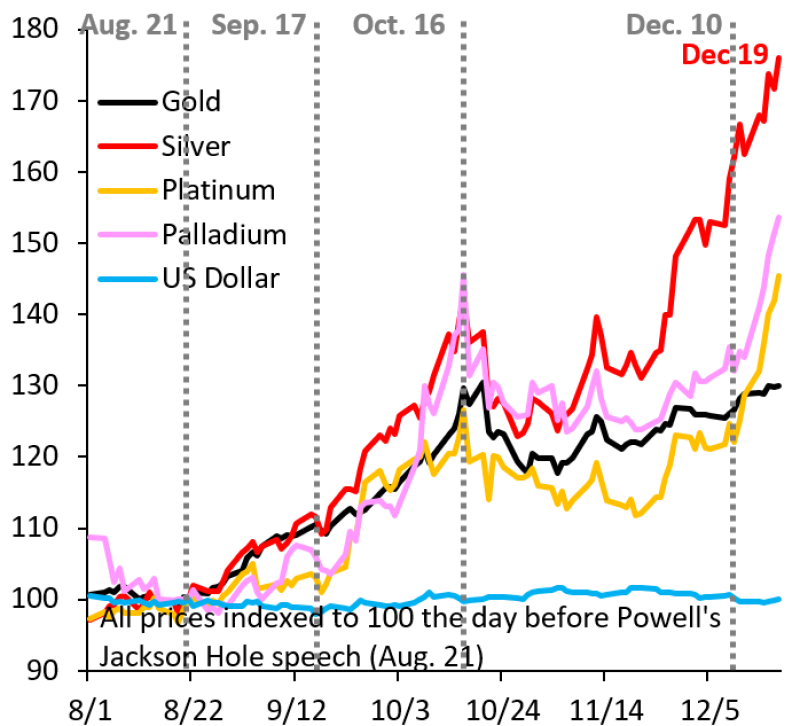

⬤ Silver prices have posted an impressive 76 percent rally since the Fed's Jackson Hole meeting on August 22. When you index everything to 100 from the day before the event, silver clearly leaves gold, platinum, and palladium in the dust. The move has sparked fresh conversations about currency debasement and what role precious metals might play going forward.

⬤ The real acceleration kicked in during early September and just kept building through October and November before pushing even higher in mid-December. By December 19, silver hit nearly 180 on the indexed scale—far ahead of the pack. Gold made it to around 130, which is solid, but silver's run was in a different league. Platinum and palladium posted gains too, though with more volatility. Meanwhile, the U.S. dollar barely budged from its starting point.

The scale of the rally has intensified discussion around currency debasement and the growing role of precious metals in the current macro environment.

⬤ What stands out are those sharp upside bursts in October and December. Silver didn't just drift higher—it surged in distinct phases that coincided with broader strength across precious metals. But even during those rallies, silver's advance was notably larger than what we saw in gold or the other metals.

⬤ This matters because sustained strength in silver often signals changing views on monetary conditions and purchasing power. A 76 percent move in just a few months points to serious momentum and volatility in the metals space. As analysts keep referencing post-Jackson Hole performance, the widening gap between precious metals and the dollar could be an important read on broader commodity trends and global liquidity.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah