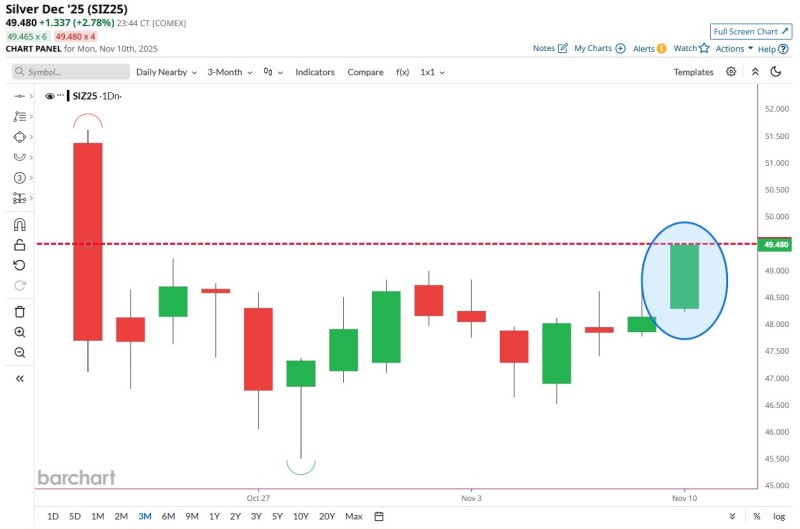

Silver (XAG) is showing serious strength in the commodities market right now, and traders are taking notice. The metal's sharp upward momentum has pushed futures to a multi-week high, bringing the psychologically critical $50 level within reach. Recent chart data highlights a clear shift in momentum, suggesting silver may be primed for further gains.

Silver Futures Analysis: Momentum Builds Near $50

Silver is "ripping to its highest price in 3 weeks," and the latest candlestick formation confirms buyers are back in control. The chart shows a strong bullish engulfing pattern within a key support zone, signaling a clean rejection of lower levels and renewed upward pressure.

Price has broken above the resistance zone near $49.00–$49.20, which previously capped several upside attempts. With silver now trading around $49.48, this technical rebound shows that bullish momentum is picking up speed. The broader upward trajectory supports the growing strength in the metal's short-term trend.

What's Driving the Silver Rally?

Several factors appear to be fueling this upward move:

- Expectations of rate cuts from central banks, which typically weaken the dollar and boost precious metals

- Rising industrial demand, particularly from solar manufacturing and electronics sectors

- Growing investor interest in safe-haven assets amid ongoing geopolitical uncertainty

Silver's unique position as both an industrial and monetary metal often amplifies upside moves when macro and industrial signals align favorably.

Technical Structure Suggests Further Upside

The chart reveals silver recently formed a rounded bottom pattern in late October, followed by a steady series of higher lows. The strong green candle on November 10 marks the most powerful upside move since mid-October.

With momentum accelerating and price reclaiming resistance, traders are now watching whether silver can hold above $49.20 and make a decisive push toward $50—a major psychological and technical barrier.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah