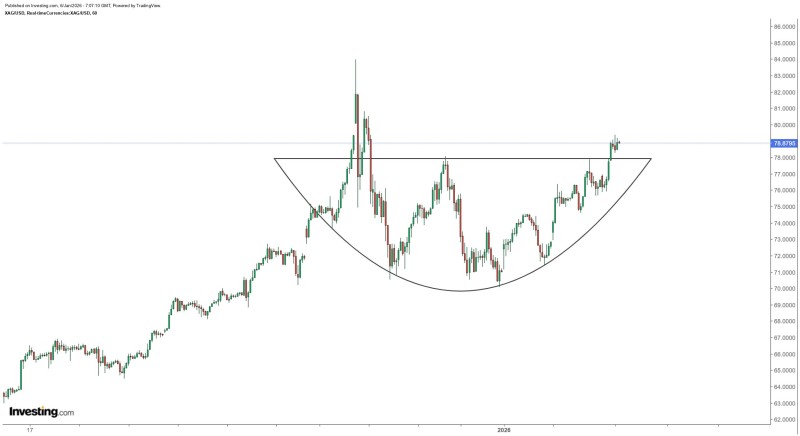

⬤ Silver (XAG) is climbing back from the brutal December 28, 2025 sell-off, and this time the recovery looks a lot healthier. Price action has stabilized and is pushing higher, with XAG/USD now trading around $78.88. The chart shows silver breaking above a rounded consolidation pattern that's been building for weeks—a sign that buyers are back in control.

⬤ After getting hammered at the end of December, silver momentum has completely flipped. The market formed a solid rounding base in the mid-70s before pushing back toward the upper-70 range. What makes this rally different? Unlike the previous spike that shot up fast and crashed just as quickly, this recovery is grinding higher through steady advances. That's typically a better sign for lasting strength.

⬤ Silver continues catching traders' attention as it rebuilds its bullish structure. The metal has reclaimed ground it lost during the sell-off and is now holding near the top of its recent range. As long as XAG stays above the mid-70s support zone and keeps making higher lows, the uptrend remains intact.

⬤ This comeback matters beyond just silver itself. Precious metals are always a barometer for broader market sentiment, and when a major asset like silver stabilizes after a sharp drop, it can lift confidence across the entire commodity complex. If XAG continues building on this foundation, it could signal renewed strength in the metals space heading into 2026.

Usman Salis

Usman Salis

Usman Salis

Usman Salis