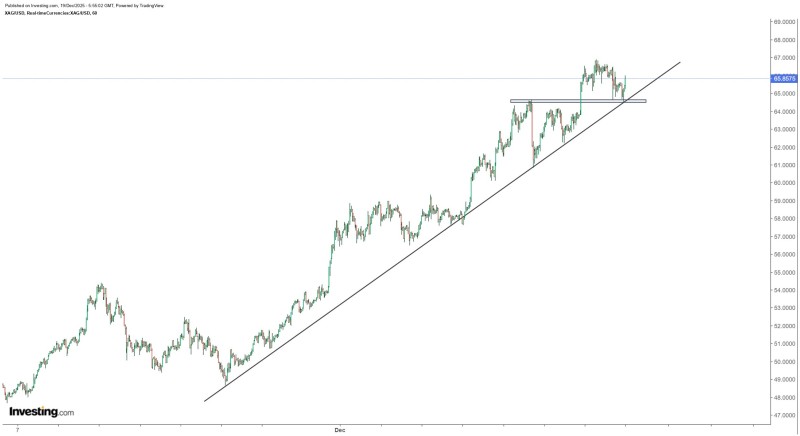

⬤ Silver (XAG) proved its strength by bouncing right off a crucial technical zone where a rising trendline met horizontal support. The metal tested this area and pushed back up, showing buyers are still ready to step in at key levels. This rebound comes just as monthly options are set to expire—a time when things can get choppy in the markets.

⬤ The chart shows silver's been riding a clean uptrend since late November. That rising trendline has caught every pullback so far, and the latest dip brought prices right back to that line again. At the same time, silver touched a level that used to be resistance before breaking through. The fact that this zone held suggests it's now acting as support, which backs up what the chart's been telling us about the overall structure.

⬤ After testing that support zone, silver bounced and started trading sideways just under recent highs. This looks more like a breather within the trend than any kind of breakdown. The chart doesn't show the support getting smashed—prices are still moving with the upward flow. Keep in mind this bounce happened on the third Friday of the month when options expire, and that can create some noise as traders close out positions rather than making real directional moves.

⬤ Looking at the bigger picture, silver holding above that trendline keeps the focus on continuation rather than reversal. As long as XAG stays above both the rising trendline and that reclaimed horizontal level, the upward bias is still on. A clean break below these would open the door to deeper pullbacks, but right now the rebound shows buyers absorbed the selling pressure. With options flows still in play, how silver handles these technical levels matters for what comes next.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi