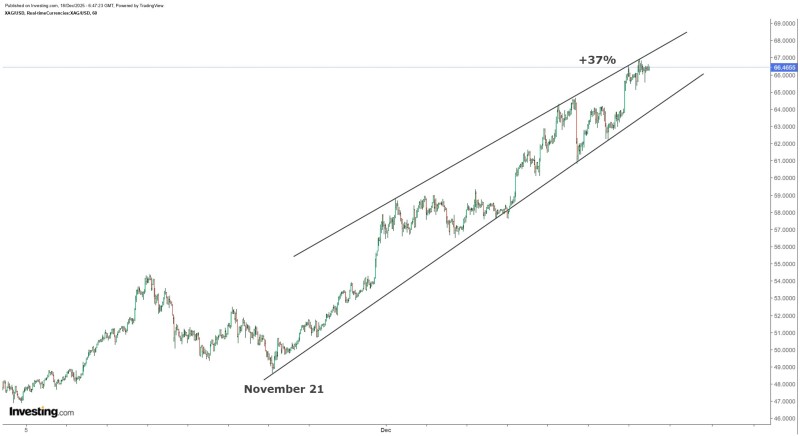

⬤ Silver prices have posted an impressive rally since November 21, with XAGUSD climbing inside a well-defined rising narrowing channel. The metal gained roughly 37% over 26 days, pushing toward the channel's upper boundary around 66.00–67.00. The move shows strong momentum in silver while raising questions about whether related assets will catch up.

⬤ The chart reveals a clear pattern of higher highs and higher lows, with price consistently respecting the channel structure. After the initial November surge, silver consolidated briefly before resuming its climb through December. The narrowing channel points to tightening price action as silver nears recent highs, showing persistent buying interest without major pullbacks.

⬤ Silver mining stocks haven't matched the metal's gains. The SIL ETF rose about 26% during the same stretch—trailing silver's 37% advance by a significant margin. This gap shows that equity investors have stayed cautious despite the metal's strong run, a pattern that's held throughout the rally.

⬤ The disconnect between silver prices and mining stocks is catching attention as silver trades near the top of its channel. These kinds of divergences often shape market views on whether a trend can hold and whether the broader sector is confirming the move. With silver at elevated levels after a fast climb, the relationship between spot prices and miners remains a key factor driving near-term sentiment.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov