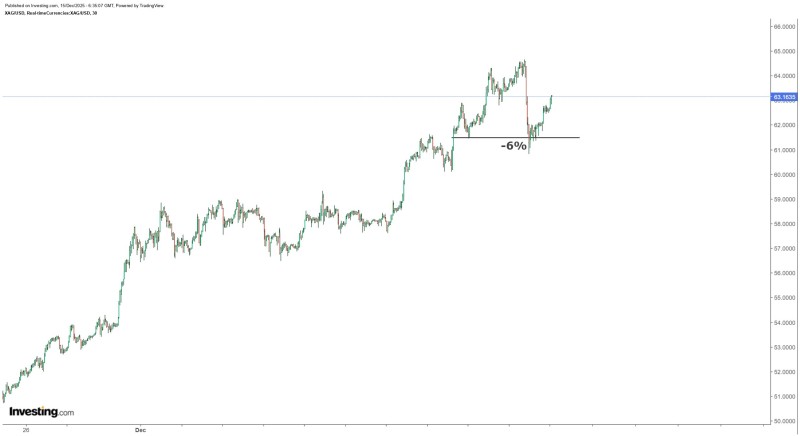

⬤ Silver jumped back above $63 after taking a beating on Friday. Spot prices dropped about 6% in just one day before snapping back up. The fast recovery looks more like a quick shakeout than any real trend change.

⬤ Charts show silver was riding high before the sudden drop pushed it below a key support zone. But that didn't last long—prices bounced right back and settled above $63 again. Seems like the selloff just flushed out weak hands, letting the metal recover once the panic selling stopped.

⬤ Even with last week's wild swings, silver's still sitting well above where it was consolidating before. The bigger picture still shows higher highs and higher lows. The fact that XAG grabbed back its support so fast shows buyers are still lurking, ready to jump in when prices dip.

⬤ This matters because silver tends to mirror risk appetite, industrial demand vibes, and where people stand on precious metals. When a metal recovers this quick after a sharp drop, it can shift short-term sentiment and keep the trend intact. If silver keeps holding above these support levels, it could steady nerves across the metals market and suggest Friday's move was just noise rather than a real momentum shift.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah