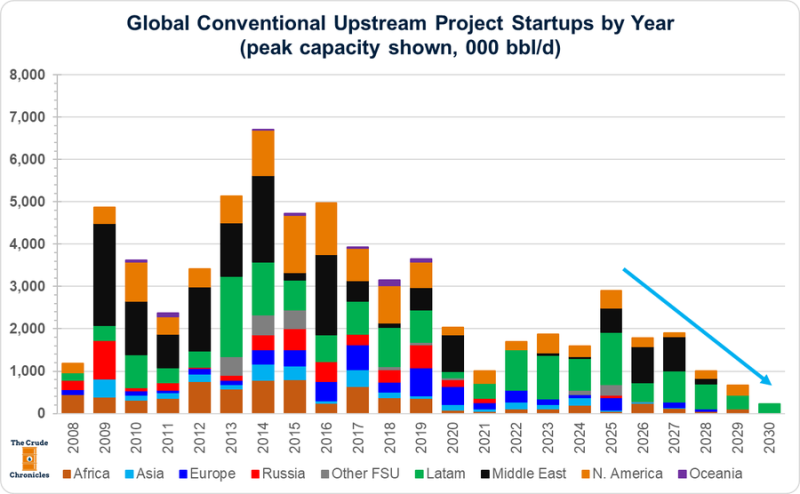

⬤ The oil industry is staring down a supply crunch that's been building quietly for years. WTI crude oil supply trends tell a stark story: conventional upstream project startups peaked around 2013 to 2014, and they've been sliding downhill ever since. The trajectory shown in recent data suggests we're heading toward virtually zero new projects by 2030.

⬤ The numbers paint a dramatic picture. New capacity additions have crashed more than 70 percent compared to the peak period. Throughout the late 2010s and into the 2020s, the bars on the chart keep shrinking, showing fewer and fewer new developments coming online across every major region. What was once a steady stream of fresh supply has slowed to a trickle.

⬤ Here's where it gets serious. Oil fields don't produce forever—they naturally decline about 6 percent every year. That's roughly 6 million barrels per day that simply disappear from global supply if nobody brings new production to replace it. And right now, replacement projects are drying up fast.

⬤ The reality is simple but uncomfortable: aging fields are dying faster than new ones are being born. Whether the industry can reverse this trend and launch enough new developments to keep pace with natural decline remains the billion-dollar question hanging over future oil availability.

Peter Smith

Peter Smith

Peter Smith

Peter Smith