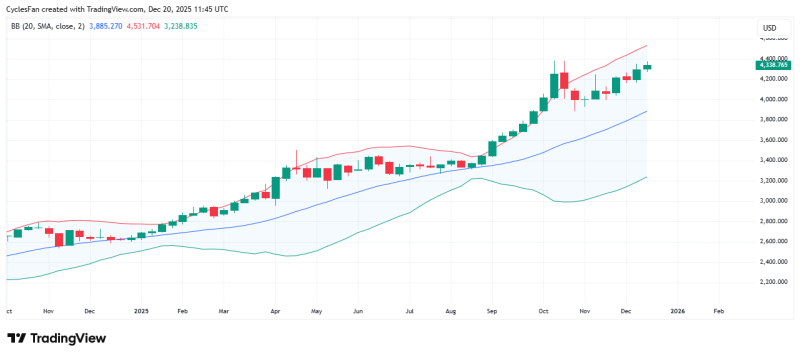

⬤ Gold is trading near cycle highs around $4,300 without confirming a new all-time high, setting up two possible paths for January. Price could either push higher in a final acceleration or start pulling back after forming a multi-week top. The metal has climbed steadily from mid-$2,000s throughout 2024 into late 2025, holding well above its medium-term trend support.

⬤ Right now, gold is hugging the upper Bollinger Band, showing strong momentum rather than signs of reversal. The 20-week moving average keeps trending upward but sits far below current price, confirming the bigger trend remains healthy despite recent sideways movement.

⬤ The first scenario points to a possible blow-off top in January, where gold could spike higher before peaking. "This view is supported by recent sharp upside movement in silver, which has already exhibited signs of accelerated price behavior," according to the analysis. The second scenario sees gold forming a top through December, then correcting back toward the rising 20-week moving average while keeping the longer uptrend intact.

⬤ What happens next matters beyond just gold traders. The metal often signals shifts in market sentiment, liquidity, and how investors view risk. Whether price breaks higher or pulls back toward support could ripple across commodities and related markets as we head into the new year.

Usman Salis

Usman Salis

Usman Salis

Usman Salis