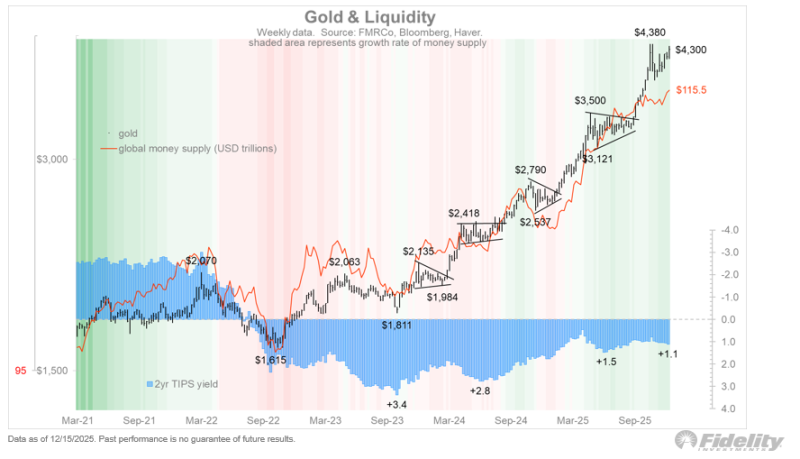

⬤ Gold is holding steady after a powerful multi-year climb, trading sideways near record highs rather than pulling back sharply. Prices remain above $4,300 despite slower global money supply growth, showing unusual strength compared to historical patterns. This sideways movement suggests the market is digesting gains rather than losing steam.

⬤ What makes gold's performance noteworthy is how it's outpaced global liquidity expansion. The metal has pushed higher even as monetary conditions evolved, demonstrating its appeal as a hard asset during periods of financial transition. The current consolidation looks healthy—prices are stabilizing at elevated levels instead of breaking down, which typically signals continued bull market momentum rather than a reversal.

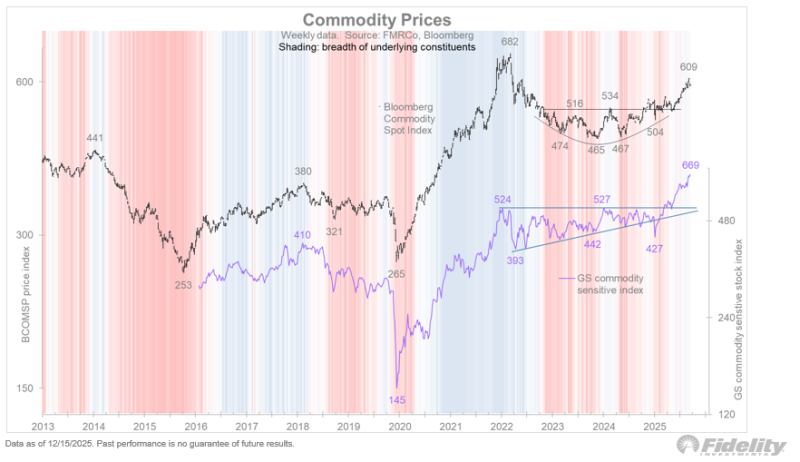

⬤ Beyond gold, the broader commodity market is catching attention. With Bitcoin potentially slowing down in 2026, commodities are emerging as an attractive alternative for investors seeking tangible assets. The Bloomberg Commodity Spot Index shows solid technical structure backed by strengthening participation across multiple sectors—not just isolated gains in one or two areas.

⬤ This matters because it points to sustained interest in real assets as market conditions shift. Gold's ability to stay near highs reflects genuine underlying strength, while commodities' improving technical picture suggests they could play a bigger role in portfolios next year. Together, these trends indicate that hard assets remain relevant, with commodities potentially stepping into the spotlight alongside gold as 2026 approaches.

Usman Salis

Usman Salis

Usman Salis

Usman Salis