Gold traders are holding their breath ahead of today's U.S. PCE inflation report - the Federal Reserve's preferred measure of price pressures. This data release could be the catalyst that finally breaks gold out of its current tight trading range.

Right now, the precious metal is caught in no man's land. Bulls and bears are essentially in a stalemate, with neither side able to gain meaningful ground.

Technical Picture Shows Indecision

According to analyst XAUUSD (Gold) - Traders, this standoff won't last much longer once we get clarity on the inflation picture.

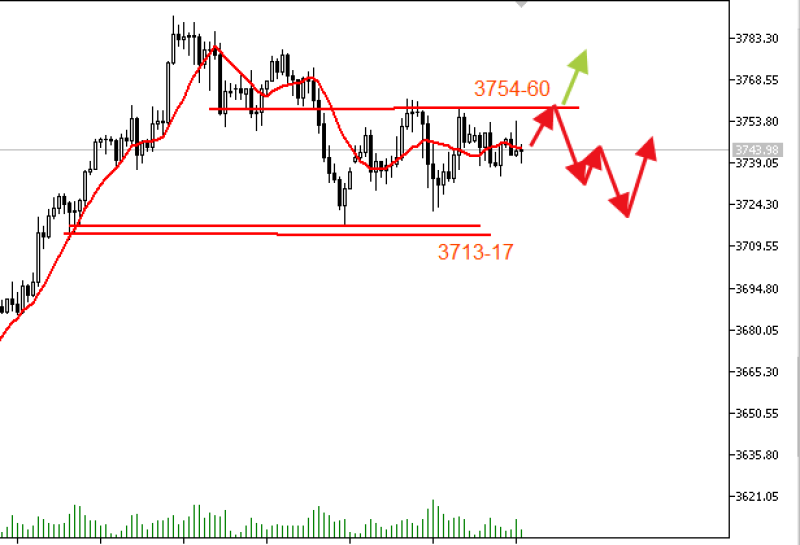

Looking at the charts, gold is clearly range-bound between two key levels:

- Support sits at $2,713-2,717 - this is the line in the sand for buyers. If this breaks, we could see a more serious selloff

- Resistance comes in around $2,754-2,760 - breaking above here would likely unleash fresh buying momentum

- Moving averages are mixed - short-term ones are pointing down (bearish), but the longer-term trend indicators still lean bullish

This technical setup perfectly captures the market's current uncertainty.

What's Driving the Action

The main headwind for gold right now is dollar strength. The greenback has been on a tear lately as investors price in a more hawkish Federal Reserve stance. But there are still plenty of reasons to own gold - ongoing geopolitical tensions and concerns about trade policies are keeping safe-haven demand alive.

The PCE data could tip the scales either way. If inflation comes in cooler than expected, it might take some pressure off the Fed to stay aggressive, which would be bullish for gold. But if we see hotter numbers, that could strengthen the dollar even more and push gold lower.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah