The Federal Reserve's latest September projections paint a more cautious picture of the inflation outlook than previously anticipated. While significant progress has been made in cooling price pressures since their 2022 peaks, the central bank now expects the journey back to its 2% target will be longer and bumpier than initially forecast. This shift has important implications for interest rate policy and market expectations going forward.

Key Findings

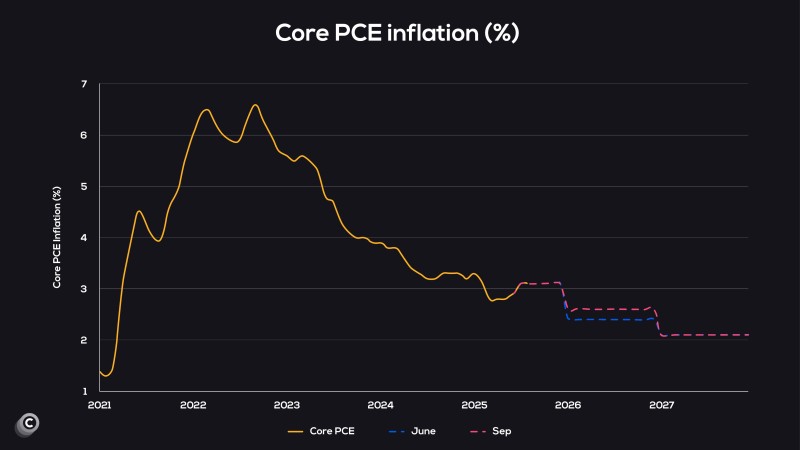

- Core PCE inflation peaked above 6% in 2022 and has since declined to approximately 3% by mid-2025, but the pace of improvement has notably slowed

- June projections were more optimistic, expecting inflation to drop close to 2.5% by 2026

- September revisions suggest inflation will hover around 3% through 2025, with the 2% target not reached until around 2027

The updated timeline represents a significant recalibration of expectations and reflects growing concerns about persistent inflationary pressures in certain sectors. Housing costs and rent inflation continue to exert upward pressure on core measures, while strong labor market conditions are maintaining elevated wage growth that slows the overall disinflation process. Additionally, resilient consumer demand across the economy is making it more difficult for businesses to reduce prices quickly.

Market Impact

This hawkish shift in Fed projections creates several ripple effects across financial markets. Growth stocks are likely to face continued pressure as expectations for rate cuts get pushed further into the future. In the bond market, longer-dated yields are expected to remain elevated, which could actually improve returns for fixed-income investors who have been waiting for higher yields. The US dollar should maintain its strength under a more restrictive Federal Reserve policy stance, while gold and other inflation hedges may see increased demand as investors position for an extended period of monetary tightening.

The September update fundamentally changes the investment landscape by signaling that restrictive monetary policy could extend well into 2026. For portfolio managers and individual investors alike, this means adjusting strategies to account for a higher-for-longer interest rate environment and preparing for the possibility that inflation's final descent to target levels may prove more challenging than originally hoped.

Usman Salis

Usman Salis

Usman Salis

Usman Salis