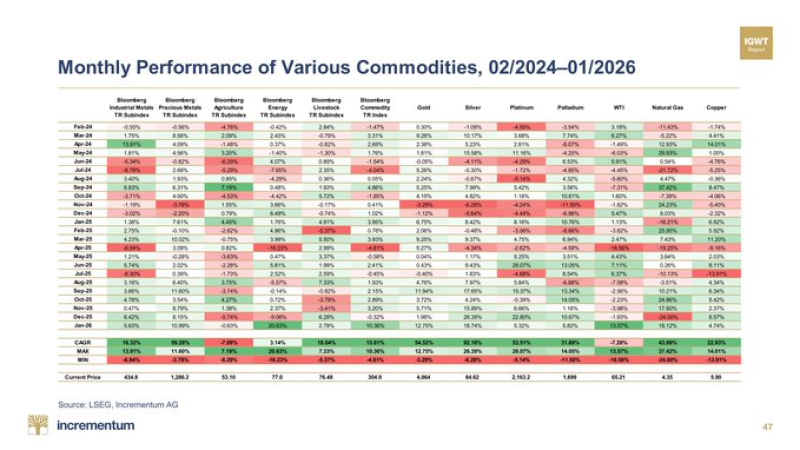

⬤ January marked a turning point for commodities, with the Bloomberg Commodity Index jumping 10.36%—the strongest monthly gain seen in the past two years. Nearly every segment participated in the rally except agriculture, signaling a genuine broad-market move rather than isolated strength in one or two assets. The data shows this wasn't a fluke—momentum built across multiple categories simultaneously.

⬤ Energy was the star performer, rocketing 20.63% higher during the month. The breakdown reveals that while agriculture sat out the party, most other commodity groups climbed alongside energy's explosive run. This reinforces the idea that January's strength wasn't just about oil and gas—it was a coordinated push across the commodity complex, with energy setting the pace.

⬤ Silver holds the top compound annual growth rate at +92.16%, while WTI crude oil shows the bottom CAGR at −7.28%, highlighting the stark contrast in longer-term performance. Even as the index rallied hard in January, the multi-month picture remains fractured. Silver's stellar multi-year run stands in sharp opposition to WTI's struggles, proving that short-term strength doesn't erase deeper structural divides. For more on silver's trajectory, check out Silver price outlook and how bulls are navigating key support levels.

⬤ The January surge matters because it shows commodities moving together in the near term, led by energy's 20% burst, while also exposing the fault lines beneath the surface. Silver and WTI tell opposite stories over the long haul, and that split defines today's commodity landscape. Traders watching crude can dive into WTI crude oil hits five-month low for recent price action, while precious metals followers might explore Gold surges 73% in first half of 2020s for additional context on the metals complex.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi