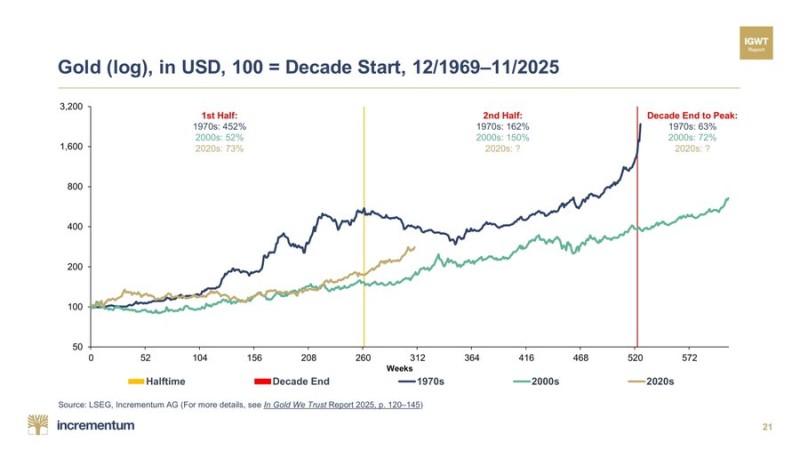

⬤ Gold has been on a tear in the early 2020s, climbing 73% so far—well ahead of the 52% gain we saw during the comparable period in the 2000s. The "In Gold We Trust" report points out that while these returns are already impressive, the real fireworks might be saved for later this decade. What's particularly interesting is that we're not even fully through 2025 yet, and gold has already posted a 61.5% gain, suggesting there's plenty of momentum left in the tank.

⬤ Looking at gold's historical patterns, there's a clear trend worth noting. The metal posted a massive 452% surge during the 1970s and a solid 150% gain in the 2000s. The current decade is shaping up to follow a similar trajectory, with the first half already delivering strong returns. Market watchers are keeping a close eye on inflation concerns and geopolitical tensions—two factors that typically push investors toward gold as a protective measure against economic uncertainty.

⬤ If gold maintains this upward momentum through the rest of the 2020s, it'll reinforce its reputation as a go-to safe-haven asset during turbulent times. The metal's performance is becoming an important barometer for measuring investor anxiety about inflation risks and broader financial market stability heading into the second half of the decade.

Usman Salis

Usman Salis

Usman Salis

Usman Salis