The AI gold rush has a new poster child—and it's Palantir Technologies. That's a valuation multiple unlike anything we've seen for a company this size. It's a testament to the hype around AI software and data analytics, but it also highlights a growing gap between Palantir's current numbers and what the market expects it to deliver.

The Numbers Tell a Wild Story

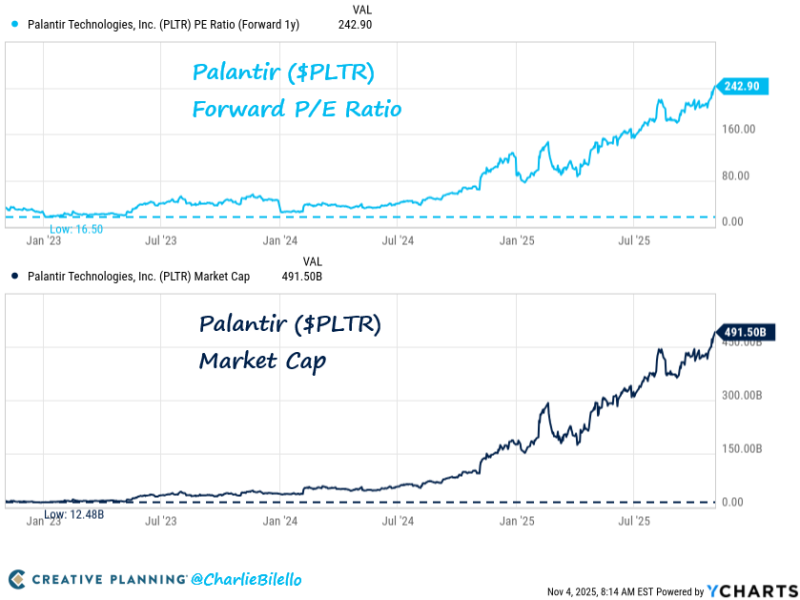

According to data shared by Charlie Bilello, the company closed yesterday at an eye-watering 242.9x forward price-to-earnings ratio, with its market cap hitting $491.5 billion.

Palantir's valuation didn't just climb—it exploded:

- Forward P/E ratio: Started near 16x in early 2023, then rocketed past 240x by November 2025

- Market cap growth: Jumped from $12.5 billion in early 2023 to nearly $500 billion by late 2025—a 39x increase in under two years

- Revenue growth: Still solid at 25–30% year-over-year, but nowhere near enough to justify the stock's moonshot

For context, Nvidia trades at 40x forward earnings, Microsoft at 32x, and Alphabet at 25x. Palantir is in a league of its own—and not necessarily in a good way.

Why the Rally?

Palantir's Artificial Intelligence Platform (AIP) has become a go-to tool for government and enterprise AI adoption, especially in defense, logistics, and critical infrastructure. Its deep ties to the U.S. Department of Defense give it a unique edge as a mission-critical AI contractor—something that sets it apart from the likes of OpenAI or C3.ai.

But here's the thing: investors aren't buying Palantir for what it is today. They're betting on what it could become—a dominant force in industrial and military AI for decades. That's a huge "AI premium," and it's baked into every dollar of the stock price.

Palantir's chart shows relentless momentum with no meaningful pullbacks since early 2024. Technically, that's impressive. Historically, it's a red flag. When valuations rise this fast without matching profit growth, corrections usually follow.

The company's future hinges on whether it can turn the hype into sustained earnings. If it can't, the market will eventually reprice the stock. Until then, Palantir remains the ultimate test case for whether AI mania is justified—or just another bubble waiting to pop.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets