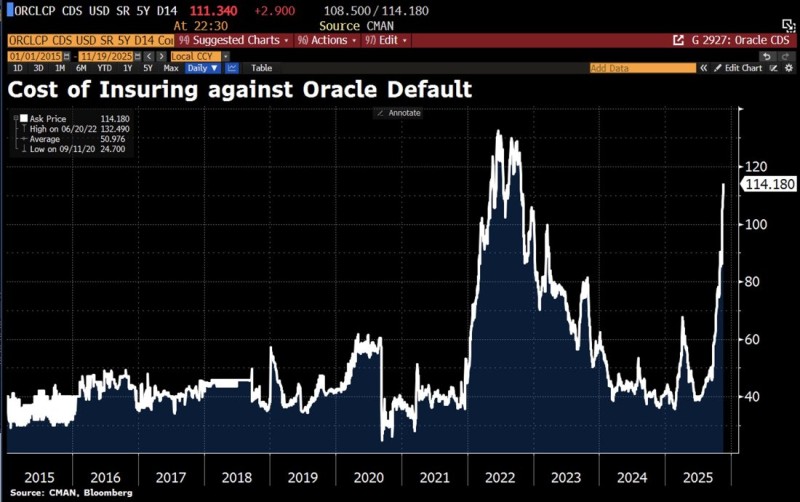

⬤ Oracle is drawing attention after its credit default swap pricing shot up sharply, with a CDS chart from 2015 to 2025 showing the cost of insuring against default climbing to around 114 basis points—among the highest levels since mid-2022. The company still hasn't secured $38 billion in financing, raising red flags about credit stability as AI-related capital demand heats up across the industry.

⬤ The chart shows Oracle's CDS stayed fairly stable for years before spiking hard during 2021–2022 and again in late 2025. Current levels sit near the top of the multi-year range, signaling heightened worry among lenders. The risk scenario centers on tightening funding conditions and rising competition from non-GPU AI models, which could squeeze Oracle's strategic position. Past market shocks like the 2008 CDS crisis and January 2025 DeepSeek event frame today's environment as vulnerable to sudden sentiment swings.

⬤ Though no deal terms or deadlines surfaced, elevated CDS levels suggest the market is pricing in higher default risk or uncertainty around Oracle's debt structure. Previous CDS peaks hit around 130 basis points in mid-2022, followed by a long decline, then a sudden 2025 surge. This pattern shows credit markets are reacting faster to funding stress signals, especially in sectors demanding massive capital for AI and cloud expansion.

⬤ Oracle's CDS rise matters because the company anchors enterprise software, cloud infrastructure, and AI-driven workloads. Any trouble securing large-scale financing could reshape expectations for corporate borrowing, lending appetite, and liquidity across AI-related industries. Higher CDS levels may signal growing sensitivity to balance-sheet risk as the next wave of AI infrastructure spending takes off.

Usman Salis

Usman Salis

Usman Salis

Usman Salis