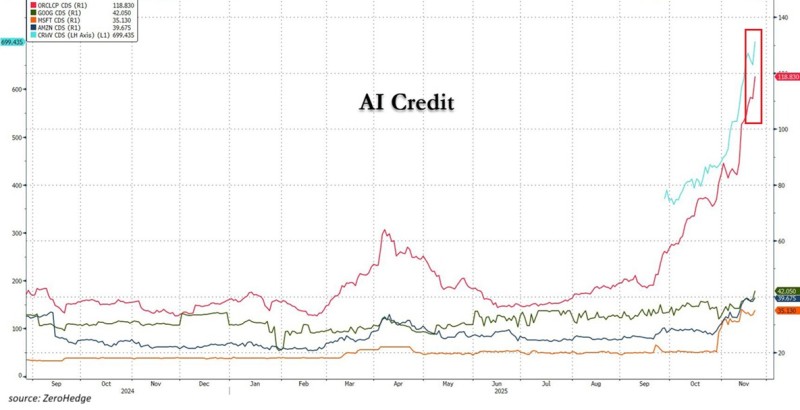

⬤ Oracle's credit markets are flashing warning signs. The company's five-year credit default swaps recently spiked to 118 basis points – the highest reading since the 2022 bear market. What's striking is how fast Oracle's protection costs have climbed compared to tech giants like Google, Microsoft and Amazon, whose CDS levels have stayed relatively stable.

⬤ The numbers tell the story. Insuring 10 million dollars of Oracle debt now costs around 118,000 dollars – triple what it was in July. We're getting close to the June 2022 peak of 127 basis points, which itself had tripled in the six months before that. Trading activity has exploded too. Roughly five billion dollars of Oracle-linked CDS changed hands in the seven weeks through November 14 – that's twenty-five times more than the same period last year.

⬤ Why is Oracle becoming such a popular credit hedge? A few things stand out. The company's pouring money into AI infrastructure, has exposure to some complex deals, and carries weaker credit ratings than its Big Tech peers. That combination makes ORCL an attractive way to bet against the AI boom. CoreWeave is showing similar stress – its five-year CDS has jumped to 699 basis points, the highest since it started trading this year. When both Oracle and CoreWeave see their protection costs surge at the same time, it suggests traders are getting nervous about credit risk in the AI space.

⬤ This rise in CDS pricing is sparking questions about whether AI spending has gotten ahead of itself. When protection costs climb this fast, it's often an early signal that markets are rethinking how much leverage and capital these high-growth companies can handle. For Oracle and others tied to massive AI infrastructure buildouts, these moves could shape how investors view their long-term stability and balance sheet strength going forward.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah