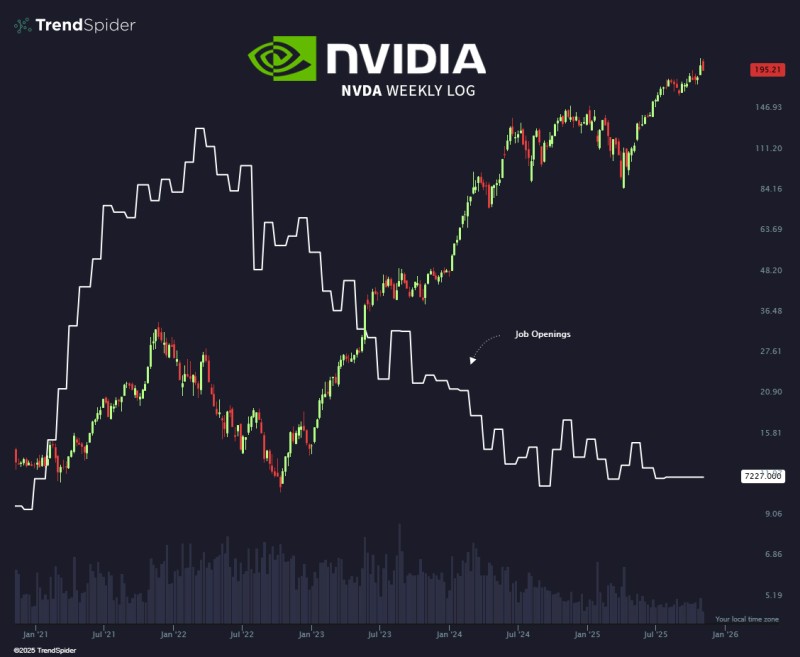

The connection between artificial intelligence and the broader economy is showing up more clearly in the data. NVIDIA's stock keeps climbing while U.S. job openings have been dropping for nearly two years, now sitting around 7,227. This growing gap is sparking questions about how AI adoption is affecting both markets and employment.

NVDA Maintains Strong Momentum

Looking at TrendSpider's analysis, the weekly logarithmic chart shows NVDA holding a clean upward trajectory from early 2023 through late 2025. The stock is steadily moving toward $195.21, driven by massive demand for GPU compute, data-center hardware, and AI infrastructure.

The pattern is unmistakable: consistent higher highs and lows across multiple quarters, strong bullish momentum during AI-driven news cycles, solid volume backing the uptrend, and no major trend breakdowns or deeper pullbacks. NVDA remains one of the strongest large-cap performers, fueled by unprecedented demand for AI computing power.

Job Openings Tell a Different Story

Below NVDA's rising price sits the job-openings line, forming a steady downward pattern from the 2022 peak. The decline has been consistent throughout 2023 and 2024, leveling off near 7,227 by late 2025 with lower highs and lows throughout. This cooling reflects broader labor market shifts, whether from macroeconomic pressures or efficiency gains tied to AI adoption.

Why This Gap Matters

AI spending keeps accelerating as enterprises, cloud providers, and research labs expand their infrastructure, driving record demand for NVIDIA's systems. This investment flows into companies like NVDA rather than traditional hiring. Meanwhile, job openings may be falling due to slower economic growth, higher interest rates, hiring freezes, or automation replacing certain roles. While the chart doesn't prove direct causation, the timing lines up with major AI adoption milestones, suggesting a shift from labor-driven to AI-driven productivity.

What It Could Mean Going Forward

This divergence might signal growing demand for compute versus declining demand for certain workforce segments, along with potential long-term changes in how companies allocate capital. Whether it's correlation or causation, these opposing trends highlight just how transformative the AI boom has become.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi