Nvidia has hit an unprecedented milestone. The chipmaker's market cap now tops the combined value of six major S&P 500 sectors — including industrials, energy, and real estate. This isn't just impressive growth; it's a fundamental shift in market structure driven by the AI revolution.

Nvidia's Market Weight Now Rivals Whole Industries

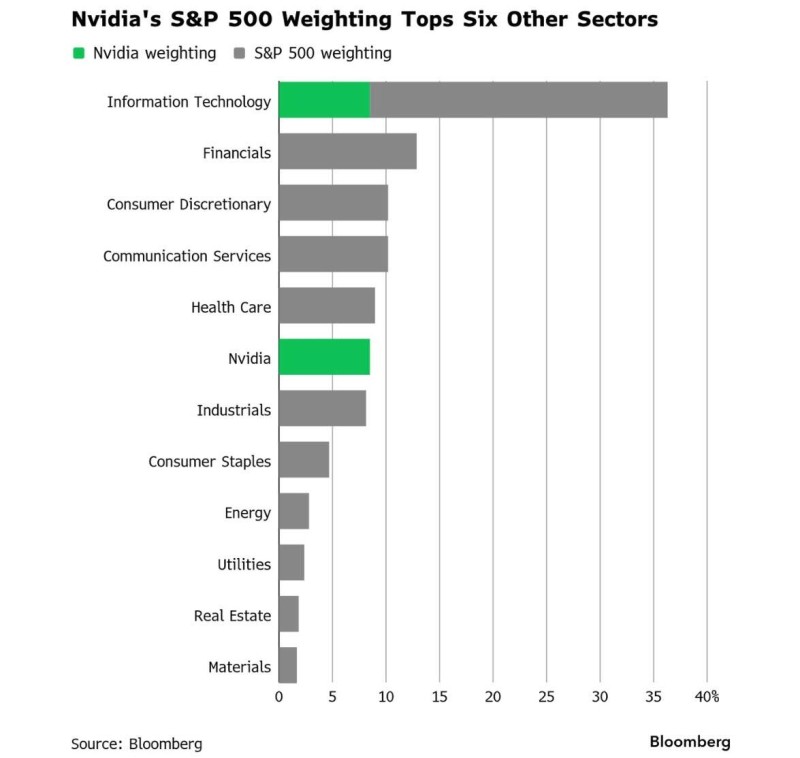

Bloomberg data shows something remarkable: Nvidia's individual S&P 500 weighting now exceeds that of six entire sectors. The visualization shared by trader zerohedge on X compares the company's index weight against each sector's total contribution.

Nvidia outweighs industrials, consumer staples, energy, utilities, real estate, and materials. It's closing in on healthcare — a sector with hundreds of major companies. Within tech itself, Nvidia represents one of the largest single-company contributions the index has ever seen. Put simply, one AI chipmaker now carries more market influence than vast swaths of the traditional economy.

The AI Revolution Behind the Numbers

Nvidia's rise tracks perfectly with the AI explosion. Its GPUs power everything from ChatGPT to Google Gemini to Anthropic Claude — essentially every major language model being built today. Three things are driving this dominance: unprecedented demand for AI data centers where Nvidia's chips are the gold standard, revenue growth that's tripled year-over-year in recent quarters, and massive passive inflows as index funds automatically buy more shares when Nvidia's weight increases. With a valuation above $3 trillion, Nvidia now sits alongside Apple and Microsoft as one of the most valuable companies in history.

Concentration Concerns

Nvidia's performance has lifted the entire market, but it's also creating concentration risk. The top five tech giants — Nvidia, Apple, Microsoft, Amazon, and Alphabet — now make up nearly a third of the S&P 500's total value. That makes the broader market increasingly sensitive to big tech moves. Still, this isn't the dot-com bubble redux. Nvidia's growth is backed by actual revenue and earnings, not speculation and hype.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah