DeepSeek officially launched Janus-Pro on January 27, 2025, positioning it as their most advanced multimodal AI system yet. The model boasts significant improvements in understanding and generating content across text, vision, and text-to-image tasks, with enhanced instruction-following capabilities and superior benchmark performance.

However, the academic announcement quickly took an unexpected turn when developer Onil Coder went viral with claims that he'd built a crypto trading bot using DeepSeek that allegedly transformed $100 into $35,000 in just one night. The extraordinary claim has ignited both excitement and skepticism across social media, raising questions about whether Janus-Pro could disrupt financial markets beyond its intended research applications.

What Makes Janus-Pro Different?

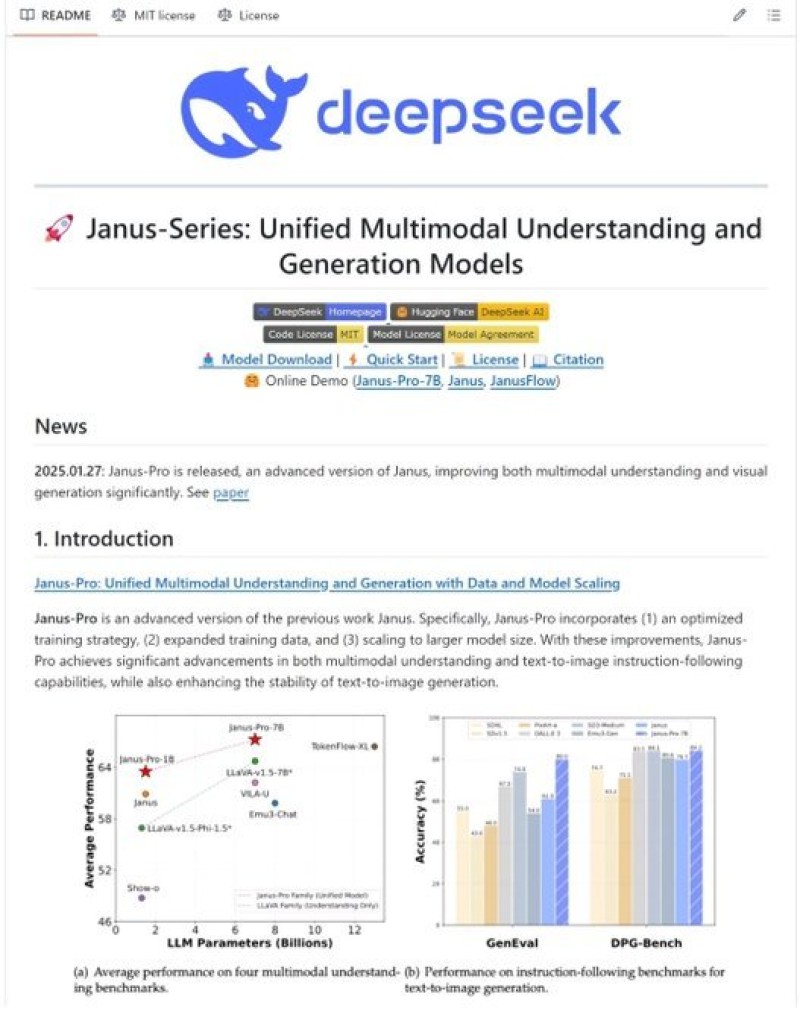

DeepSeek positions Janus-Pro as a major upgrade from their previous models, featuring an optimized training strategy, expanded datasets, and larger-scale parameter scaling. According to their benchmark data, the model delivers significant improvements in multimodal reasoning, text-to-image generation, and following complex instructions. The company's charts show Janus-Pro outperforming established competitors across various evaluation metrics like GenEval and DPG-Bench.

The model's multimodal capabilities mean it can simultaneously process and analyze text, images, and other data formats - a feature that could theoretically give it an edge in financial analysis by processing market charts, news feeds, and numerical data all at once.

The Viral Trading Claims

The buzz around Janus-Pro intensified when @Onil_coder tweeted about his alleged trading success, claiming his AI-powered bot generated a 35,000% return overnight. While he offered early access to interested users, the claims remain purely anecdotal without any verified trading data or transparent methodology.

Crypto trading is notoriously volatile, and while AI can certainly help identify patterns and execute trades faster than human traders, sustaining such extreme profits typically involves enormous risk. The lack of supporting evidence makes it impossible to verify whether these results are genuine, reproducible, or simply the result of lucky timing in an unpredictable market.

The Bigger Picture for AI in Finance

The intersection of advanced AI models and cryptocurrency trading presents both exciting opportunities and serious concerns. AI can undoubtedly enhance trading through faster pattern recognition and automated execution, but it can just as easily amplify losses when market conditions shift unexpectedly. The opacity surrounding these trading algorithms makes it nearly impossible for outsiders to assess their true effectiveness or risk profiles.

Furthermore, if multimodal AI systems like Janus-Pro do prove effective at financial trading, regulators may eventually intervene to prevent market manipulation or ensure fair trading practices. The financial industry has historically been cautious about disruptive technologies that could destabilize markets or create unfair advantages.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah