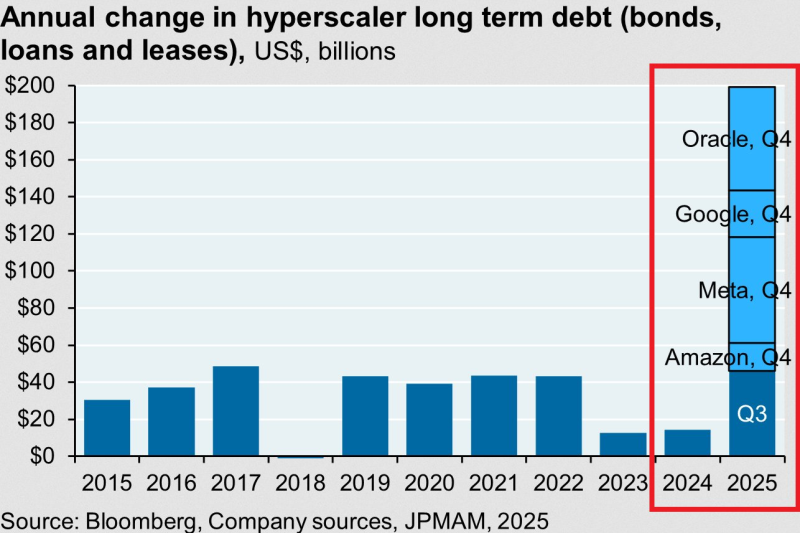

⬤ Meta, Google besides Oracle jointly lifted their long term debt by close to $200 billion during 2025 producing one of the most forceful borrowing streaks the technology industry has ever registered. Data links this huge financing wave to the contest for AI infrastructure dominance. The figures speak plainly - the amount raised this year towers over the yearly increments logged from 2015 through 2023, which usually sat between $20 billion and $50 billion.

⬤ The surge struck hardest in the second half of 2025. Amazon moved first in Q3; Oracle, Google or Meta followed in Q4. The four giants now stake their balance sheets on artificial intelligence funnelling money into data centres computing capacity and network gear built for heavier AI loads. Spending speed climbed so fast that the muted debt rise of 2024 now resembles the quiet before the storm.

The scale of borrowing this year surpasses every annual increase recorded from 2015 through 2023, which shows how large the current expansion is.

⬤ The $200 billion already includes off-balance-sheet financing - the true obligations tied to AI growth reach further than standard debt numbers show. The hyperscalers draw on every funding route to match soaring infrastructure bills. Bloomberg figures and corporate filings reveal a plain fact - the financial framework that supports AI growth has shifted and those firms accept record leverage to remain competitive.

⬤ The borrowing surge matters because it underlines how earnestly Big Tech treats the AI shift. When four of the world's most powerful technology companies together add $200 billion in liabilities within twelve months, the move spreads through credit markets, steers investment cycles and reshapes the wider tech environment. The infrastructure contest is no longer only about invention - it is about who can finance the future quickest and that question is now settled through debt commitments that would have appeared impossible only a few years back.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova