Wall Street's biggest bank is throwing cold water on the AI infrastructure boom. While tech giants prepare to pour record amounts into data centers and chips, JPMorgan suggests the economic payoff may be far smaller than the headline numbers suggest.

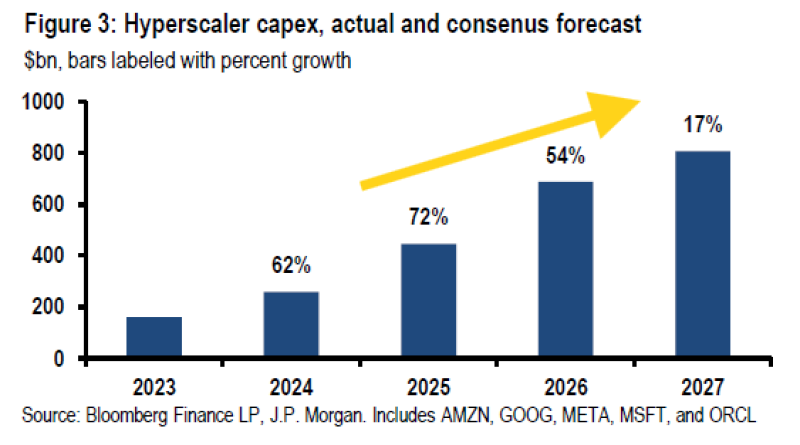

Hyperscalers Plan 54% Capex Jump in 2026

JPMorgan economist Michael Feroli cautioned investors not to confuse massive AI infrastructure spending with actual economic expansion. Updated consensus forecasts now show Amazon, Alphabet, Meta, Microsoft, and Oracle ramping up capital expenditures by 54% in 2026—a sharp increase from the earlier 33% projection.

The spending trajectory tells a striking story: hyperscalers boosted capex by 62% in 2024 and are expected to jump 72% in 2025 before moderating to 17% growth in 2027.

Company guidance suggests even these aggressive numbers might be conservative. Midpoint outlooks from Amazon, Alphabet, and Meta point to roughly 60% growth, which would push combined global hyperscaler spending to approximately $715 billion.

Microsoft sits at the center of this buildout as Azure capacity and AI compute infrastructure continue expanding across data centers worldwide. More context on this trend appears in AI infrastructure spending surge and the cloud giants investment cycle.

Why $715B in AI Investment Won't Lift GDP

Here's where Feroli's analysis gets interesting. JPMorgan emphasized that higher equipment investment doesn't automatically translate into higher gross domestic product.

As he noted, Technology hardware purchases are strongly correlated with the tech equipment trade deficit.

In plain terms, a huge chunk of that spending flows straight into imported semiconductors and servers rather than domestic production. American companies write the checks, but Asian manufacturers see most of the revenue.

The same dynamic is explored in the analysis of hyperscaler capex impact on Nvidia, where supply chain geography matters more than investment size.

What This Means for the AI Boom

The findings suggest the Microsoft-led AI infrastructure cycle may expand global computing capacity without proportionally lifting economic output. The scale of spending highlights real technological acceleration, but macroeconomic impact depends heavily on supply chains and international manufacturing—not just the headline size of corporate investment.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah