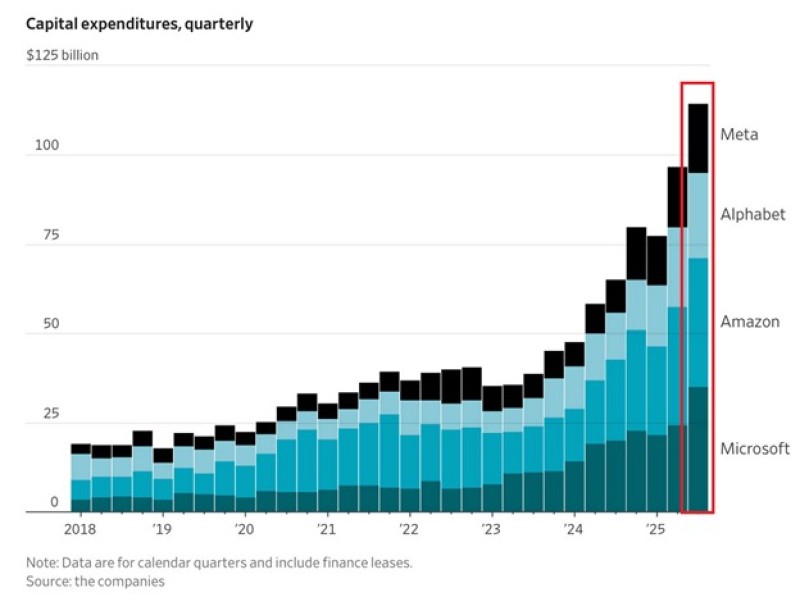

A striking new chart reveals just how massive Big Tech's latest spending wave has become. In Q3 2025, Meta, Alphabet, Amazon, and Microsoft combined to spend a record $112 billion on capital expenditures. This isn't just another tech cycle—it's an acceleration unlike anything we've seen before, signaling that the global AI buildout has entered a full-blown industrial phase.

Big Tech's Record Quarter Fueled by AI Ambitions

Market analyst Adam Kobeissi from The Kobeissi Letter highlighted data showing an almost vertical climb in capital spending starting in mid-2023. The four tech giants have effectively doubled their collective CapEx since early 2024 and tripled it compared to mid-2023.

Meta leads the charge as the biggest spender, followed closely by Alphabet and Amazon, while Microsoft maintains a steep upward trajectory as it expands Azure globally. All four are pouring resources into:

- Data centers and GPU clusters for AI model training

- Custom chip development and high-performance computing hardware

- Energy infrastructure, cooling systems, and global fiber networks

This surge shows that owning compute capacity has become the strategic imperative of the AI era.

Company Spending Breakdown

Meta now leads with guidance between $70–72 billion in CapEx for 2025, expected to climb even higher in 2026. Most of this goes toward AI data centers, custom hardware, and supporting its Llama open-source models. Alphabet projects $91–93 billion this year as it scales Gemini AI and expands Google Cloud for generative workloads. Amazon raised its forecast to $125 billion for 2025—the highest of the group—driven by AWS's AI training infrastructure and in-house chips like Trainium. Microsoft, after a 45% CapEx jump last fiscal year, expects spending could hit $94 billion in 2026 as demand for OpenAI-powered Azure services continues to explode.

Why This Spending Wave Is Different

This surge represents a fundamental shift in how tech companies invest. Instead of focusing solely on software R&D, the world's largest firms are now obsessed with controlling compute capacity—the scarce resource that powers artificial intelligence. AI models demand enormous computational power, and companies that own the data centers and chip supply chains gain decisive strategic advantages. These expenditures, once considered cyclical, are now viewed as strategic assets that will determine who dominates not just cloud computing but the entire AI economy.

Meta's Surprising Transformation

One unexpected development stands out: Meta's emergence as the top AI infrastructure spender. Once criticized for excessive spending on virtual reality projects, the company has pivoted hard toward AI compute and data platforms. Its strategy now centers on productivity and advertising efficiency powered by machine learning, showing how even social media companies are evolving into infrastructure-level players in the AI ecosystem.

The Broader Economic Impact

This spending boom marks the beginning of what analysts are calling the AI industrial era. Data centers are becoming the new factories, GPUs the new machinery, and electricity the new oil. With $112 billion in quarterly CapEx, these four companies are building the backbone for the next phase of global digital growth. Their investments will reshape cloud computing, chip demand, energy consumption, real estate development, and employment in tech hubs worldwide.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov