Steve Cohen's story is one of those rare Wall Street tales where natural talent meets relentless drive. Starting as a junior options trader in the late 1970s, Cohen discovered he had an almost supernatural ability to read markets and make split-second decisions that printed money. Over the next four decades, he turned that gift into one of the largest personal fortunes in finance, weathered a massive regulatory storm, and emerged still standing at the top of the hedge fund world.

Steve Cohen's Early Career and First Earnings

Cohen's journey to billionaire status kicked off in 1978 when he scored his first real job at Gruntal & Co., working in their options arbitrage department. He'd just graduated from Wharton, and honestly, nobody expected what happened next. On his literal first day of trading, this 22-year-old kid made $8,000 for the firm. By the end of that first week, he'd racked up $100,000 in profits. His bosses probably thought they'd hit the lottery.

The setup at Gruntal was perfect for someone like Cohen—he got paid mostly on commission, which meant the better he traded, the more he made. And he traded really, really well. Within a couple of years, he was pulling down six figures annually, which in early 1980s money was absolutely crazy for someone barely out of college. Cohen had this aggressive style where he'd jump in and out of positions constantly, sometimes holding stocks for just minutes, always seeming to catch the right momentum at the right time.

Building SAC Capital: The Path to Billions

The real turning point came in 1992 when Cohen decided to stop making other people rich and start his own shop. He launched SAC Capital Advisors with $25 million—$10 million from his own pocket and another $15 million from investors who'd seen what he could do. He set up in a pretty unremarkable office space, but what happened inside those walls was anything but ordinary.

SAC Capital became an absolute money-printing machine. Through the 90s and into the 2000s, Cohen was regularly posting returns north of 30% per year, even after taking his hefty fees. There were years when Cohen personally took home between $1 billion and $2 billion. Think about that for a second—a billion dollars in a single year. By 2009, Steve Cohen net worth had already hit around $8 billion, putting him in rarified air among the world's ultra-wealthy.

What made SAC special was Cohen's approach. He ran a huge operation with hundreds of analysts digging up information, feeding it to portfolio managers who'd execute trades at lightning speed. Cohen himself was still trading his own book within the fund, managing billions of his personal money alongside client capital. At the peak, SAC was managing $16 billion and was considered one of the most sophisticated trading operations on the planet.

Steve Cohen Net Worth Today and Current Earnings

Things got messy in 2013 when SAC Capital got caught up in an insider trading scandal. The firm pleaded guilty and paid a staggering $1.8 billion fine—one of the largest in Wall Street history. Cohen shut down SAC and converted everything into Point72 Asset Management, which initially only managed his family's money. But here's the thing about Cohen—he's basically unsinkable.

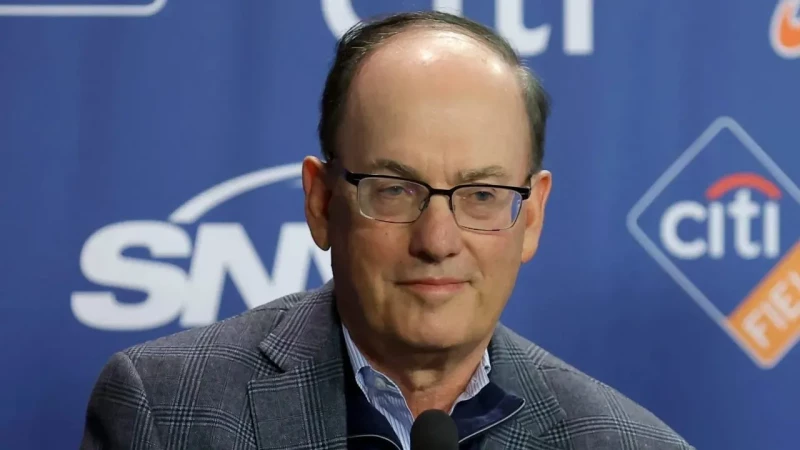

Today, Steve Cohen net worth sits at around $21 billion, making him one of the 100 richest people on Earth. Point72 is back managing outside money again and has about $35 billion in assets. Cohen makes his money from several streams now: the management and performance fees from Point72, returns on his massive personal portfolio, and various other ventures including the New York Mets baseball team, which he bought for $2.4 billion in 2020.

How much does he make annually? It's hard to pin down exactly because it swings wildly based on how the markets treat him, but financial folks estimate he's probably bringing in somewhere between $500 million and $1.5 billion in good years. His art collection alone is worth over a billion bucks—we're talking Picassos, Warhols, Damien Hirsts, the works. He lives in a 35,000-square-foot mansion in Greenwich, Connecticut, and basically lives like you'd imagine someone with his wealth would live.

Cohen's Philosophy on Success and Wealth Building

Cohen's been pretty open over the years about what he thinks it takes to make it big in finance. One of his core beliefs is that you've got to be okay with being wrong. He's said that even his best traders are wrong 40% of the time, and the key is managing those losses rather than just celebrating the wins. Markets are humbling, and if you can't handle failure, you're toast.

He's also huge on never stopping learning. Cohen believes markets constantly evolve, and what worked last year might be totally useless today. You've got to adapt or die. Another thing he's known for is hiring people who are smarter than him and then getting out of their way. He's built his empire by surrounding himself with brilliant minds and creating an environment where they can do their best work.

Cohen also preaches that ego will kill you in trading. The market doesn't care about your reputation, your track record, or your feelings. It just is what it is, and you need to react to reality, not what you wish reality would be. And maybe most important in his playbook is risk management. He's said repeatedly that before you even think about returns, you need to think about how much you're willing to lose and size your bets accordingly. That's how you survive the inevitable rough patches.

What's interesting about Cohen is that he's insisted he'd still be trading even if he didn't need the money. For him, it's about the intellectual challenge, the competition, the game itself. The fact that this passion has resulted in a Steve Cohen net worth of $21 billion? Well, that's just been a very nice side effect of doing what he loves at an absolutely elite level for over 40 years.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov