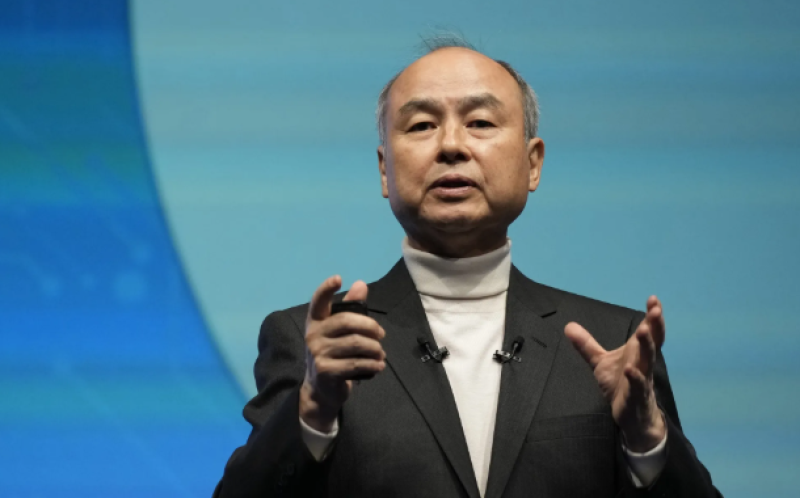

Imagine losing $70 billion in a single day and still coming back stronger than ever. That's exactly what happened to Masayoshi Son, the man behind SoftBank. Born in 1957 to a Korean-Japanese family living in poverty on the outskirts of Tosu, Japan, Son faced discrimination and hardship from day one. His father was a bootlegger and pig breeder, and young Masayoshi grew up in a shanty town where opportunities seemed impossible.

But Son had something different—an unshakeable belief in technology's power to change the world. He moved to America as a teenager, sold his first invention for a million dollars while still in college, and went on to create SoftBank, one of the most influential investment firms in tech history. Today, he's worth billions and controls investments in over 400 companies, including some of the biggest names in technology. His $20 million bet on a then-unknown Chinese company called Alibaba turned into $75 billion, making it one of the best investments ever made. This is the story of how a kid from nowhere became the CEO of SoftBank and one of the most powerful tech investors on the planet.

The First Fortune: How the CEO of SoftBank Earned His Initial Million

Here's where things get interesting. While studying economics and computer science at UC Berkeley, Son wasn't just hitting the books—he was already thinking like an entrepreneur. He got together with some classmates and built something pretty innovative for the time: a multilingual translator that could convert Japanese into English and German. It was 1980, and this kind of technology was groundbreaking.

Son sold the patent to Sharp Corporation for around $1 million. Not bad for a college kid, right? But he didn't just pocket the money and relax. He had another hustle going on the side. Son started importing Space Invaders and Pac-Man arcade machines from Japan and leasing them out to bars and restaurants around the Berkeley campus. These were the golden years of arcade games, and people couldn't get enough of them. Between the translator sale and his arcade business, Son was making serious money while still in school.

This wasn't just about earning cash, though. These early ventures taught him something crucial: how to spot opportunities before everyone else does and how to turn ideas into actual profits. The money from these deals gave him the startup capital he'd need for what came next.

Early Career Path and the Birth of SoftBank

After graduating from Berkeley in 1980 with his economics degree, Son tried his hand at another startup called Unison in Oakland, California. A Japanese company called Kyocera ended up buying it, but Son felt something pulling him back to Japan. In 1981, at just 24 years old, he took his million-dollar earnings and founded what would become his life's work—Nihon SoftBank. The name was later shortened to just SoftBank.

Now here's the crazy part: when Son started the company, he literally had zero software products to sell. Think about that for a second. He started a software distribution company without any software. But Son had vision and confidence that made people believe in him. He somehow convinced Joshin, a major electronics retailer in Osaka, and Hudson, a big Japanese software company, to give him exclusive distribution deals. It was pure hustle and persuasion.

And it worked. Within three years—by 1984—SoftBank had grabbed more than half of Japan's entire retail market for computer software. Son went from a nobody to a major player in Japan's booming tech scene almost overnight. While exact salary numbers from the 1980s aren't public, what we do know is that SoftBank's explosive growth made Son wealthy and gave him the reputation and resources to think even bigger. This was just the warm-up act.

Career Peak and the Alibaba Investment That Changed Everything

By the 1990s and 2000s, the CEO of SoftBank was playing in a completely different league. Son pushed SoftBank beyond just software, getting into telecommunications, internet services, and making strategic investments left and right. In 1996, he teamed up with media mogul Rupert Murdoch to buy a 21 percent stake in Asahi National Broadcasting. Some people called it a foreign invasion of Japanese media, but Son didn't care—he was building an empire.

Then came 2000, and the moment that would define his entire career. Son heard about a Chinese guy named Jack Ma who was starting an online marketplace called Alibaba. The company had no business plan, zero revenue, and most people thought it was a long shot. But Son met with Ma and something clicked. He later said Ma's eyes were "very strong, shiny" and that he could see the guy had real charisma and leadership. So Son did something crazy—he invested $20 million in a company that basically didn't exist yet.

That investment would eventually grow to be worth around $75 billion by 2014 when Alibaba went public. It's considered one of the best venture capital bets in history. But before we get too carried away with the success story, let's talk about the disaster that almost destroyed him.

During the dot-com crash of 2000-2002, Son lost more than $70 billion of his personal wealth. Yeah, you read that right—$70 billion. His fortune went from $78 billion to almost nothing. SoftBank's stock lost 93 percent of its value in a single day. At the time, it was the biggest personal financial loss in human history. Most people would've quit right there, but not Son. He kept going, and his Alibaba bet eventually saved him.

By the 2010s, Son had rebuilt everything and then some. As CEO of SoftBank, he was pulling in about $93 million a year in salary, plus another $125 million in dividends from his stake in the company. Not too shabby for someone who'd lost everything a decade earlier.

Current Wealth and the Vision Fund Era

Fast forward to 2025, and Masayoshi Son is sitting on a fortune worth somewhere between $17 billion and $69 billion, depending on who's doing the math and how SoftBank's stock is performing. He owns about 29 percent of SoftBank Group—that's 421,661 shares as of September 2024. The company went public in December 2018, raising over $21 billion, and it's been a wild ride ever since.

Today, the CEO of SoftBank oversees investments in more than 400 companies. That's not a typo—400 companies. But the crown jewel of his empire is probably ARM Holdings, the British semiconductor company that SoftBank bought for $31 billion back in 2016. SoftBank owns 90 percent of ARM, and with ARM's current market value at $173 billion, that stake alone is worth around $155 billion. Not a bad purchase.

In 2017, Son did something that made everyone's jaw drop—he created the Vision Fund with $100 billion in capital. It's the biggest technology investment fund in history, backed by heavy hitters like Apple and Saudi Arabia's sovereign wealth fund. The Vision Fund has money in Uber, WeWork, DoorDash, Grab, Slack, and tons of other companies focused on AI, robotics, and futuristic tech.

Just recently, in January 2025, Son was named chairman of The Stargate Project, a massive AI infrastructure venture with OpenAI, Oracle, and MGX. He's also planning to drop $100 billion in the U.S. over the next four years, focusing on artificial intelligence, semiconductors, and data centers. The goal? Creating about 100,000 jobs. Plus, he's launched SB OpenAI Japan with Sam Altman to bring AI services to Japanese companies. At 67 years old, Son's still making moves like he's just getting started.

Core Philosophy: Masayoshi Son's Principles for Becoming Successful

What makes Son tick? Over the years, the CEO of SoftBank has shared the principles that guide everything he does. If you want to understand how someone goes from poverty to billions, these are the lessons worth paying attention to.

- Think Big and Take Bold Risks: Son's whole philosophy boils down to this: "Think big; think disruptive. Execute with full passion." He's not interested in safe bets. Son has said he'd rather invest in a company that has a 30 percent chance of success but could change the world than one with a 99 percent chance that won't make much difference. He believes that "as long as you continue to challenge, there is no limit" and that your only limitation is what your mind decides. Unless you give up, there are no boundaries to what you can achieve.

- Embrace Long-Term Vision: While most CEOs are worried about next quarter's earnings, Son's thinking in terms of centuries. Literally. He created a 300-year plan for SoftBank. The goal? Making it a $1 trillion company. That's not normal, but that's the point. His philosophy is that "the digital revolution will make mankind happier and more productive, and that won't change over the next 300 years." This long-term thinking lets him make bets that other people think are insane, but that's exactly why they pay off.

- Invest in Visionary Founders, Not Just Companies: Here's something famous about Son—when the WeWork founder Adam Neumann came to pitch him, Son said, "I don't want to see your deck." He wasn't interested in the PowerPoint presentation. He wanted to see the person behind the idea. When Son met Jack Ma from Alibaba, he said, "His eyes were very strong. Shiny eyes. I could tell from the way he talked that he had charisma and leadership." Son invests in people, not spreadsheets. He looks for founders who have vision and the ability to inspire others.

- Learn from Failure Without Making Excuses: When things go wrong—and they will—Son doesn't waste time blaming others or making excuses. His rule is simple: "Whenever there is a big difficulty, I don't make excuses. Instead, I say I will solve it even if everybody leaves." He thinks that "once you try to make an excuse or accuse someone else, your mind stops thinking." After losing $70 billion in the dot-com crash, Son didn't quit or point fingers. He focused on what came next, and that mindset helped him build back even bigger.

- Pursue the Information Revolution: Everything Son does comes back to one core belief—that technology, especially AI and the Internet of Things, will completely transform human civilization. He sees it as the third great revolution: "Mankind had the agricultural revolution, the industrial revolution, and now this third one, the information revolution." SoftBank's mission is "Information Revolution—Happiness for everyone." Son genuinely believes we're heading toward a future where "the human race and super intelligence will coexist to create a richer and happier life." Whether you buy into that vision or not, you can't deny he's betting billions on it.

- Be Contrarian When Necessary: Son's advice is straightforward: "When everyone is running one way, try running the other way." He's made his fortune by going against the crowd. While everyone else thought Alibaba was too risky, Son invested. While others doubted AI's potential, Son went all-in. True innovation doesn't come from following the herd—it comes from having the guts to go in a different direction when you see something others don't.

- Never Stop Learning and Adapting: Even with all his success, Son hasn't stopped learning. He reads constantly—business books, technology, history, philosophy, whatever expands his thinking. He believes "wisdom and knowledge are the most valuable things in the body." In a world where technology changes every few years, you can't stay stuck in old ways of thinking. Son's still evolving, still learning, still adapting. That's why at 67, he's still making billion-dollar bets on the future.

Son's journey from a poor kid in a Japanese shanty town to one of the world's most powerful tech investors shows what's possible when you combine vision, resilience, and an absolute refusal to think small. He's lost billions and made them back. He's failed spectacularly and succeeded even more spectacularly. Today, with SoftBank positioned at the center of the AI revolution, Son's still pushing forward. As he likes to say, "Do not give up. At that point, growth stops." And clearly, he's got no plans to stop anytime soon.

Mostafa Razzak

Mostafa Razzak

Mostafa Razzak

Mostafa Razzak