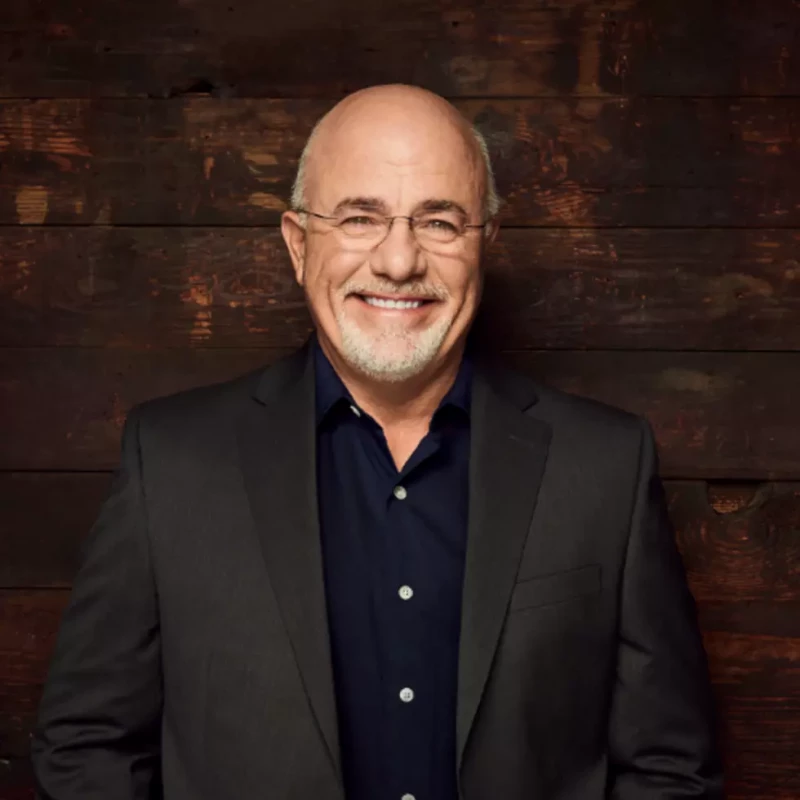

Dave Ramsey went from bankruptcy to building a fortune worth $200 million, and his story is pretty wild when you think about it. The guy who tells everyone to avoid debt like the plague actually lost everything because of debt back in the late 1980s. Now he's one of the most recognizable voices in personal finance, reaching millions of people every week through his radio show, books, and courses. What makes his story interesting isn't just the money he's made, but how he made it by sticking to principles that go against pretty much everything modern consumer culture tells us to do.

Early Career: From Real Estate Hotshot to Losing It All

Dave Ramsey made his first real money flipping houses when he was barely out of college. After graduating from the University of Tennessee with a finance and real estate degree, he jumped straight into the property market in the early 1980s. By the time he was 26, the guy had a real estate portfolio worth over $4 million. That's crazy money for someone that young, especially back then. He was buying properties with borrowed money from banks, fixing them up or just holding them, and riding the real estate wave. At his peak during this period, Ramsey was pulling in serious cash and living large with all the stuff young rich guys buy.

Then everything fell apart. The banks that had loaned him all that money got bought out by bigger banks, and the new owners wanted their money back immediately. Ramsey couldn't come up with the cash to cover all those loans at once, and by 1988 he had to file for bankruptcy. He lost the properties, the cars, everything. It was a complete disaster. But here's the thing about hitting rock bottom that hard: it either breaks you or it teaches you something. For Ramsey, losing everything became the foundation for building something way bigger than a real estate portfolio. That painful experience shaped every piece of financial advice he'd give for the next three decades.

Building the Empire: Radio Shows, Books, and a Whole Company

After going broke, Ramsey took a job counseling couples who were struggling with money, which makes sense since he'd just lived through his own financial nightmare. He started teaching small classes at a church in Nashville about how to manage money and get out of debt. In 1992, he launched a radio show called "The Money Game" that would eventually become "The Dave Ramsey Show." That radio show became the core of everything else he built. Today it reaches over 18 million listeners on more than 600 stations across the country, and that's where a huge chunk of Dave Ramsey's net worth comes from.

His career really exploded when he published "Financial Peace" in 1992, and then "The Total Money Makeover" in 2003. That second book sold over 10 million copies and turned Ramsey into a household name. He founded Ramsey Solutions back in 1992, which started small but grew into this massive company that does financial education through books, courses, live events, and online content. During the 2010s, when things really took off, Ramsey was making tens of millions every year from radio deals, book sales, his Financial Peace University courses, and speaking gigs. His company now has over 1,000 employees and brings in more than $300 million annually. Not bad for a guy who was bankrupt 15 years earlier.

Dave Ramsey Net Worth Right Now: Where the Money Comes From

These days, Dave Ramsey's net worth sits around $200 million, and get this - it's all built without using any debt. Unlike his twenties when he was leveraged up to his eyeballs in real estate loans, Ramsey now owns everything outright. No mortgages, no business loans, nothing. His money comes from several different places: the radio show generates millions in advertising, his books keep selling like crazy with multiple bestsellers still in print, and Ramsey Solutions offers a bunch of products like the Financial Peace University course that over 6 million people have taken, the Every Dollar budgeting app, and a program where he refers people to financial advisors.

People who track this stuff estimate Ramsey personally makes somewhere between $15 and $20 million a year from all these different sources. He owns a massive 14,000 square foot mansion in Franklin, Tennessee, plus the whole Ramsey Solutions headquarters campus. He's living proof that you can get seriously wealthy without owing anyone a dime. It's pretty ironic when you think about it - the guy who went bankrupt is now worth $200 million and tells everyone debt is stupid. But that's exactly why people listen to him. He's been on both sides of the equation.

Dave Ramsey's Main Ideas on Getting Rich

Dave Ramsey built his fortune by following some pretty specific rules, and he shares them with anyone who'll listen. His famous "Baby Steps" program breaks everything down into seven stages: first save $1,000 for emergencies, then pay off all your debt starting with the smallest balance first (the "debt snowball"), build up 3 to 6 months of living expenses in savings, start investing 15% of your income for retirement, save for your kids' college if you have them, pay off your house early, and finally build wealth and give money away. Ramsey hammers home the idea of spending less than you make, treating debt like poison including car loans and credit cards, and building wealth slowly by investing in mutual funds consistently.

His whole philosophy boils down to this: personal finance is 80% behavior and only 20% knowledge. He thinks anyone can build wealth no matter what they earn if they're willing to delay buying stuff they want, work extra jobs if they need to, and stick to a tight budget. He's got this saying people quote all the time: "Live like no one else now so you can live like no one else later." His hardline stance against debt, even mortgages which most financial advisors say are fine, gets him a lot of criticism. But looking at Dave Ramsey's net worth of $200 million built completely debt-free, it's hard to argue the approach doesn't work if you actually follow it.

What Ramsey's Success Actually Proves

Dave Ramsey going from bankruptcy to a $200 million fortune basically validates everything he teaches. He took his biggest failure and turned it into a career helping millions of Americans dig out of debt and build wealth. He's created this whole movement around financial responsibility that's spread through churches, businesses, and families everywhere. Critics say his investment advice is too conservative and his anti-debt position is too extreme for things like home mortgages, but his supporters point to thousands of people who've paid off crazy amounts of debt and built serious wealth doing exactly what he says.

Ramsey keeps expanding his reach through podcasts, YouTube, and social media where his tough-love money advice connects with younger people buried in student loans and credit card debt. Whether you agree with everything he says or not, the guy proved you can come back from total financial disaster and build lasting wealth. His message never changes: get out of debt, live on a budget, invest for the long haul, and be generous with your money. For someone who lost everything at 28, getting to a net worth of $200 million by never using debt again is pretty solid proof that his system actually works.

Peter Smith

Peter Smith

Peter Smith

Peter Smith