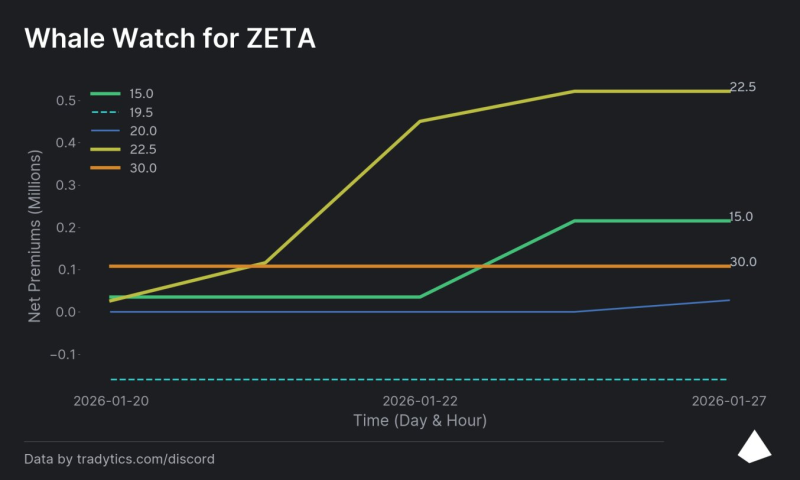

⬤ ZETA options activity picked up in late January, with net premiums climbing to roughly $0.53 million as major players repositioned across the options chain. The data shows a two-phase surge rather than one clear direction. Net premiums spread unevenly across strikes, pointing to targeted plays instead of broad accumulation.

⬤ The first wave focused on the $22.5 strike, where net premiums climbed steadily and topped out just above $0.5 million—the highest level on the chart. This buildup happened while ZETA traded below that mark, showing call exposure positioned above current price. During this time, the $30 strike held steady near $0.1 million in net premiums, while the $19.5 strike stayed negative throughout.

⬤ The second phase brought a clear shift into the $15 strike, where net premiums rose to just over $0.2 million. This rotation moved positioning closer to the money as ZETA hovered near $20. The $20 strike itself only saw modest positive premiums by period's end, staying secondary to the concentration at $22.5 and $15. The chart shows capital rotating rather than expanding evenly.

⬤ Options premium rotation like this often signals how big players handle uncertainty around key price zones. The mix of above-price exposure at $22.5 and increased in-the-money positioning at $15 suggests hedging or split conviction rather than one dominant bet. For ZETA, the clustering around these strikes marks the $20 zone as the main reference point for near-term volatility.

Usman Salis

Usman Salis

Usman Salis

Usman Salis