⬤ Taiwan Semiconductor Manufacturing Company (TSM) is riding a wave of AI-fueled growth that's pushing its profitability to impressive new heights. The chipmaker's operating margins are on track to reach somewhere between 54% and 56% by early 2026—a remarkable jump from the roughly 41% recorded back in 2021.

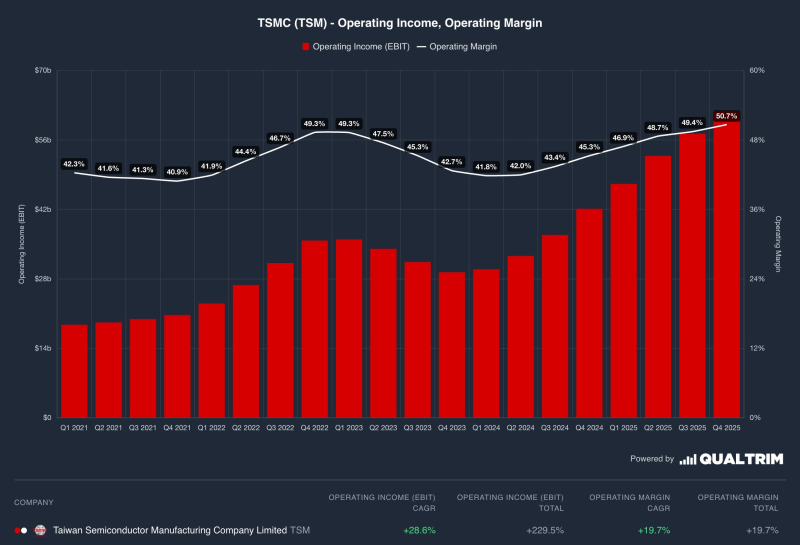

⬤ The numbers tell a compelling story. Operating income has climbed steadily from the mid-teen billions in 2021 to nearly $60 billion by late 2025. Meanwhile, operating margin hit approximately 50.7% in the most recent quarter. TSMC holds a commanding position in AI chip manufacturing, and analysts estimate its AI-related revenue is growing at about 50% annually. The company's dominance in this space has been highlighted in earlier reports, including TSMC Projects 25% Annual Revenue Growth Through 2029 on AI Chip Demand and TSMC Stock Surges as October Revenue Hits Record $11.9B.

⬤ Looking at the trajectory, there was a brief slowdown in 2023, but momentum picked back up through 2024 and 2025. Over the entire period, operating income grew at a compound annual rate of 28.6%, while operating margin expanded at 19.7% CAGR. This upward push toward the 50% threshold reflects how AI infrastructure demand is reshaping the semiconductor landscape. The pattern aligns with broader expectations outlined in TSMC Projects 40% Growth Rate in AI Chip Revenue Over Next 5 Years.

⬤ If margins do reach the mid-50% range as projected, it would underscore just how central AI infrastructure has become to the tech supply chain. The combination of expanding income and rising margins shows that advanced manufacturing capacity tied to AI isn't just a temporary boost—it's fundamentally changing competitive dynamics and financial performance across the semiconductor industry.

Peter Smith

Peter Smith

Peter Smith

Peter Smith