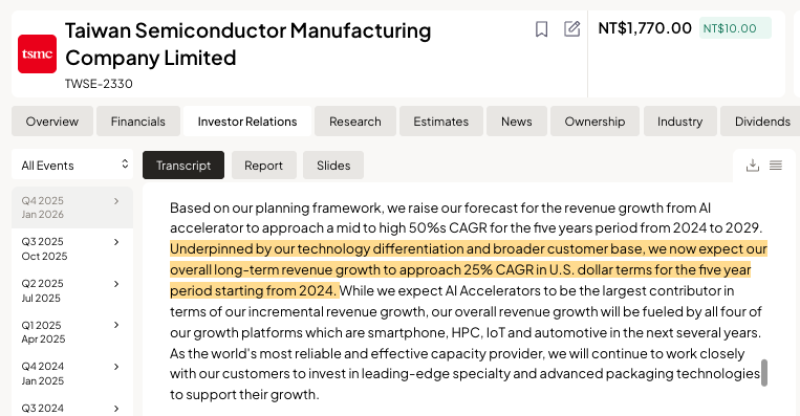

⬤ Taiwan Semiconductor Manufacturing Company (TSM) laid out an ambitious growth roadmap, targeting nearly 25% compound annual revenue growth from 2024 through 2029. The chipmaking giant expects AI-related processors to drive the bulk of this expansion, banking on its technological edge and manufacturing scale across global markets.

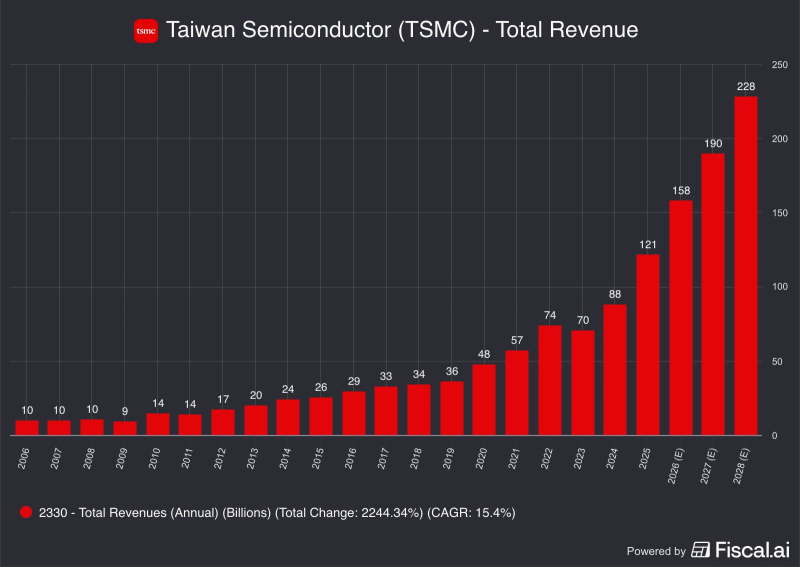

⬤ TSMC's revenue trajectory tells a remarkable story—climbing from around $10 billion in the mid-2000s to an estimated $200 billion by the late 2020s. The steepest growth kicked in after 2020, mirroring the explosion in high-performance computing and AI workloads. Company executives pointed to their advanced process technology, cutting-edge manufacturing capabilities, and broad customer relationships as the foundation for sustained growth.

AI accelerators are expected to be the largest contributor to incremental revenue growth during the forecast period.

⬤ Breaking down the growth drivers, AI accelerators take the top spot, but smartphones, high-performance computing, IoT devices, and automotive chips remain solid contributors. TSMC continues pouring capital into next-generation manufacturing facilities and advanced packaging technologies to keep pace with customer needs. The company's revenue projections are denominated in U.S. dollars, factoring in both volume increases and a richer product mix.

⬤ TSMC's outlook carries weight beyond its own balance sheet. As the backbone of the global chip supply chain, the company's aggressive growth plans signal major capital investments, expanded production capacity, and deeper collaboration with tech companies building tomorrow's AI infrastructure. If these projections hold, AI demand will cement its position as the semiconductor industry's primary growth engine for years to come.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah