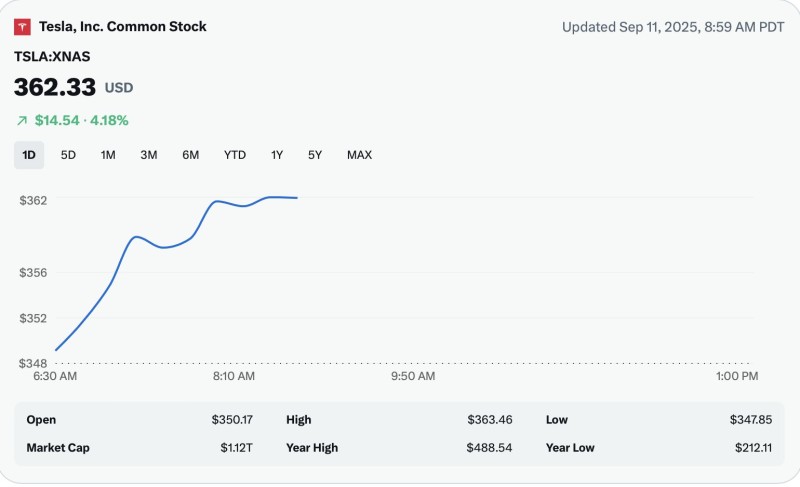

Tesla's stock jumped 4.18% on September 11, 2025, closing at $362.33 as investors responded positively to a series of product announcements and service expansions. The electric vehicle giant's shares climbed throughout the trading session after revealing new energy storage solutions and expanding its robotaxi operations to Bay Area airports. This rally reflects growing confidence in Tesla's diversified approach beyond just car manufacturing.

Market Performance Shows Strong Momentum

Tesla opened at $350.17 and quickly gained steam, reaching an intraday peak of $363.46 before settling at the day's close. The $14.54 gain pushed the company's market cap to $1.12 trillion, demonstrating substantial investor interest. While the stock remains well above its yearly low of $212.11, it's still trading below its 2025 peak of $488.54, suggesting room for further growth.

The trading pattern showed a sharp morning surge followed by consolidation around the $362 level, indicating strong buying pressure and potential for continued upward movement.

Product Innovation Fuels Investor Excitement

According to Tesla What's New, the key catalyst behind the rally was Tesla's announcement of the Megapack 3 and Megablock energy storage systems. These large-scale solutions are designed to enhance renewable energy infrastructure by providing faster and more efficient grid-scale storage. The timing couldn't be better as utilities worldwide seek reliable ways to store clean energy.

Additionally, Tesla rolled out software update 2025.32.3 across its vehicle fleet, bringing new features and improvements that showcase the company's commitment to continuously enhancing its products through over-the-air updates. This software-first approach differentiates Tesla from traditional automakers and creates ongoing value for customers.

The expansion of Tesla's Robotaxi service to Bay Area airports represents another significant milestone. This move into autonomous mobility services opens new revenue streams while reinforcing Tesla's position as a leader in AI-powered transportation technology.

Technical Outlook and Price Targets

- Immediate resistance around $370 could be tested if momentum continues

- A breakout above $370 may target the $400 psychological level

- Key support at $350 needs to hold for the bullish trend to remain intact

- Volume patterns suggest institutional buying interest

With multiple growth drivers now in play, Tesla appears positioned for further gains if it can maintain support above current levels. The combination of energy storage expansion, software innovation, and autonomous service growth gives investors multiple reasons to stay optimistic about the company's future prospects.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah