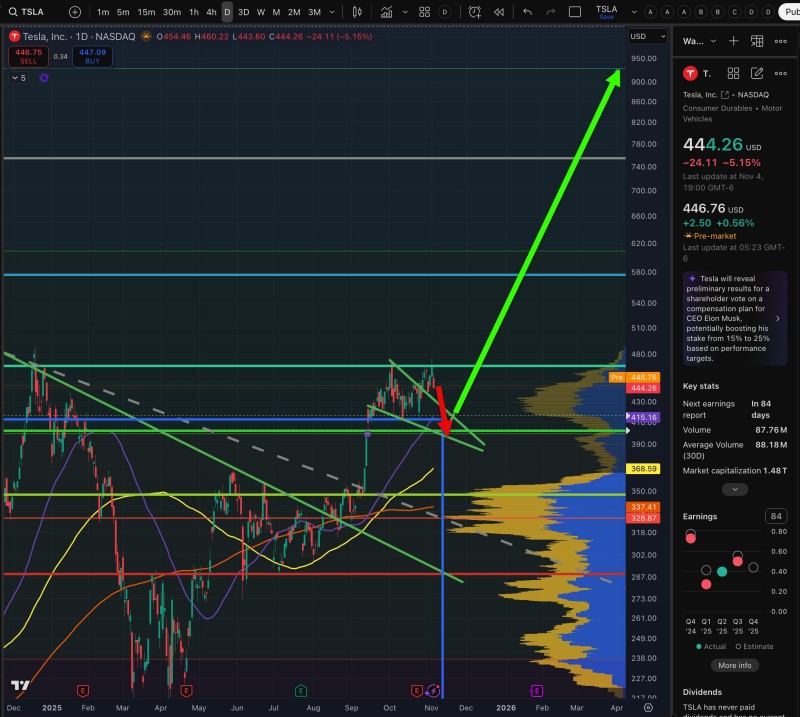

After months of consolidation, Tesla (TSLA) chart is showing signs of recovery. The stock recently dipped to around $444, down about 5% on the day, but the technical picture suggests the bullish structure remains intact.

The chart shows a clear roadmap: a red corrective arrow indicating a possible retest toward the $398 support gap, followed by a green projection arrow targeting $900 — a potential long-term objective if momentum resumes. Despite macroeconomic pressure, investors seem confident in Tesla's path as projects like Cybercab, Optimus, and the new Roadster approach launch.

Key Technical Levels and Market Context

Trader Micro2Macr0, who authored the original analysis, highlights that the $398–$430 range remains critical support, marked by dense volume where accumulation occurred. An upward trendline from early 2025 continues holding, reinforcing bullish momentum above these levels.

The green projection outlines a path toward $900, suggesting significant upside once consolidation wraps up. The golden cross between the 50-day and 200-day moving averages in early 2025 strengthens the bullish case. While Tesla could retest lower levels if the market weakens, fundamentals backed by AI robotics, autonomous driving, and energy storage remain solid.

Tesla's Strategic Position and Growth Catalysts

Tesla is positioned to outperform once macro headwinds ease. The upcoming shareholder vote on CEO Elon Musk's compensation plan should clarify executive alignment and sentiment. New ventures like Cybercab and Optimus represent major growth drivers beyond automotive. The chart supports this story: a deep base after years of consolidation, followed by recovery as innovation drives enthusiasm. Key levels include the $398 support gap, $430–$450 consolidation zone, $900 target, and trendline support from early 2025.

Long-Term Outlook

Tesla has consolidated for nearly four and a half years under tough conditions, weathering supply chain issues, margin pressure, and rate hikes while expanding into robotics, AI, and energy. With M3 money supply stabilizing and capital returning to tech, the $398–$450 zone may represent long-term accumulation. If support holds, the path toward $900 by 2026 remains viable. For investors, this could mark the shift from patience to payoff as Tesla evolves into a diversified AI and energy powerhouse.

Recent AI news, including, has added another layer of optimism around the company’s technological roadmap. Investors see this as a crucial development that could accelerate Tesla’s transition from an automaker to an AI-driven platform for mobility and robotics.

Usman Salis

Usman Salis

Usman Salis

Usman Salis