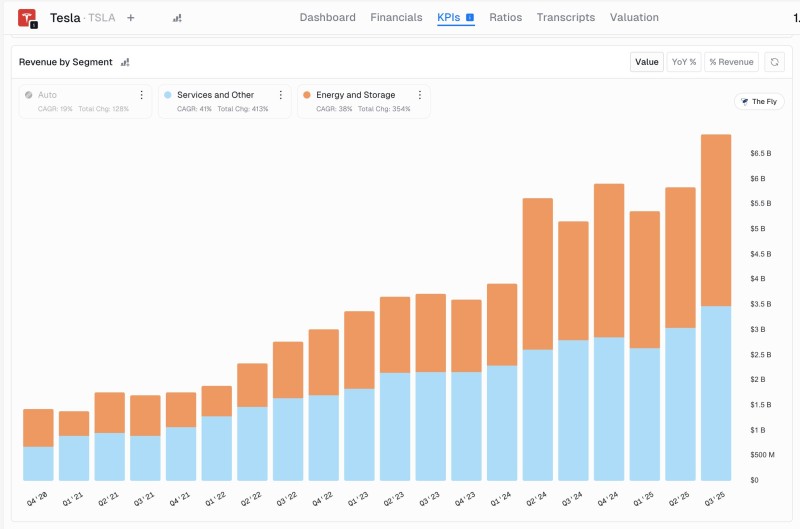

⬤ Tesla's latest revenue chart tells a story that goes way beyond selling cars. While electric vehicles still bring in the most money, the company's services and energy divisions have been quietly building serious momentum. Quarter after quarter, these non-automotive segments are claiming a bigger slice of the pie, proving Tesla has successfully evolved into something more than just an automaker.

⬤ The Services and Other division has been on an absolute tear. The numbers speak for themselves—this segment has grown over 400% cumulatively, powered by a compound annual growth rate above 40%. From 2021 through 2025, the quarterly bars on the chart keep climbing higher, driven by software subscriptions, vehicle maintenance, and various recurring revenue streams. What started as a relatively small contributor has transformed into a major business line that keeps generating cash even when car sales fluctuate.

⬤ Energy and Storage is pulling similar moves. With a compound growth rate around 38% and total expansion exceeding 350%, this segment has become impossible to ignore. The real inflection point hit in 2023, when energy revenue started shooting up dramatically. By 2024 and into 2025, battery storage systems and grid solutions are generating revenue figures that match the services business in size. Demand for energy storage products has clearly exploded, making this one of Tesla's fastest-growing divisions.

⬤ The bigger picture here is diversification. Yes, automotive sales still dominate the revenue chart, but services and energy are increasingly carrying their weight. This matters because it means Tesla isn't putting all its eggs in one basket anymore. When car sales hit a rough patch, these other segments can help smooth things out. The company is deliberately positioning itself as a multi-faceted tech and energy player rather than just another car manufacturer—and the revenue mix is starting to reflect exactly that transformation.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov