Tesla hit a rough patch this week when European sales data showed a concerning 20% year-over-year decline in August. The news sent ripples through the stock, but for investors, this isn't just about one bad month. It's about whether Tesla can hold its ground in Europe's increasingly crowded EV landscape, where both traditional automakers and aggressive new players are fighting for every sale.

Europe's EV Battlefield Gets Tougher

The August sales drop, highlighted by market observer Bella, comes at a challenging time for Tesla's European operations. The company faces pressure from multiple directions: established luxury brands like BMW and Mercedes are rolling out compelling EV alternatives, while Chinese manufacturers like BYD are winning customers with lower prices and solid quality.

Europe has been crucial for Tesla's growth story, but the market's dependence on government incentives makes it volatile. When Germany scaled back EV subsidies, Tesla felt the impact immediately. Without those financial sweeteners, consumers are taking a harder look at the competition, and Tesla's premium pricing becomes a tougher sell.

Technical Picture Shows Weakness

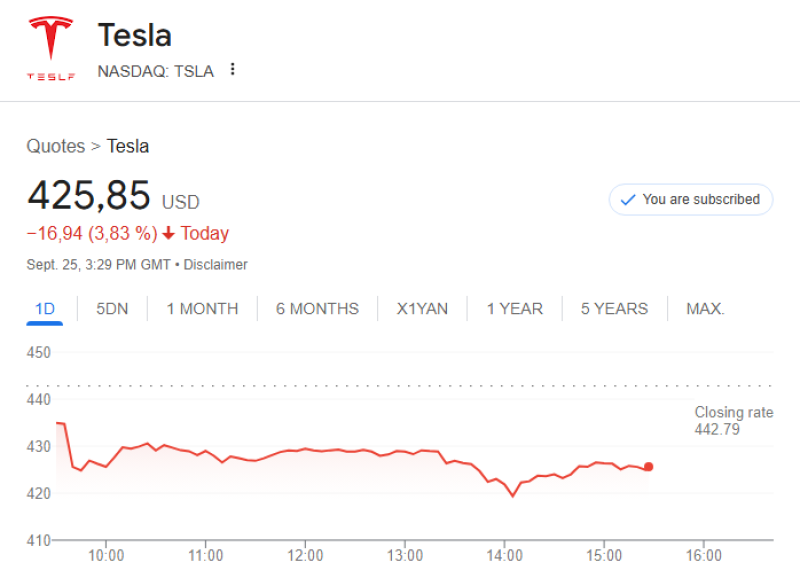

The stock chart tells a concerning story. Tesla is testing support around the $420-$425 level, and if that breaks, we could see a slide toward $400. Recent attempts to rally have stalled at the $445-$450 resistance zone, creating a pattern of lower highs that suggests buyers are losing confidence. The surge in selling volume when the European sales news hit confirms that institutions are taking notice and adjusting positions accordingly.

Moving averages are pointing downward, and without fresh positive catalysts, the technical setup suggests more downside risk than upside potential in the near term.

Why Tesla Is Losing Ground

The European struggles aren't happening in a vacuum. Several factors are working against Tesla right now:

- Competition is fierce: European luxury brands are finally delivering EVs that match Tesla's appeal, while Chinese companies are proving that quality doesn't have to cost premium prices

- Economic headwinds: High inflation and interest rates are making consumers more cautious about big-ticket purchases like cars

- Policy shifts: The reduction of EV subsidies, particularly in Germany, has removed a key advantage Tesla enjoyed

- Product refresh cycle: Without major new model launches on the horizon, Tesla risks looking stale compared to rivals rolling out fresh designs

Looking Ahead

Tesla's European sales decline is a wake-up call that even market leaders can't take growth for granted when competition heats up and economic conditions shift. The company's stock might find support at current levels if broader market conditions improve, but sustained weakness in demand could trigger deeper selling.

For long-term investors, this could represent a buying opportunity if Tesla can address its European challenges through competitive pricing, product innovation, and strategic marketing. However, the company needs to prove it can adapt to a more competitive landscape where its first-mover advantage is no longer enough to guarantee success.

The European EV market will likely remain challenging, but Tesla's response to these pressures will determine whether this is a temporary setback or the beginning of a more significant market share erosion.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah