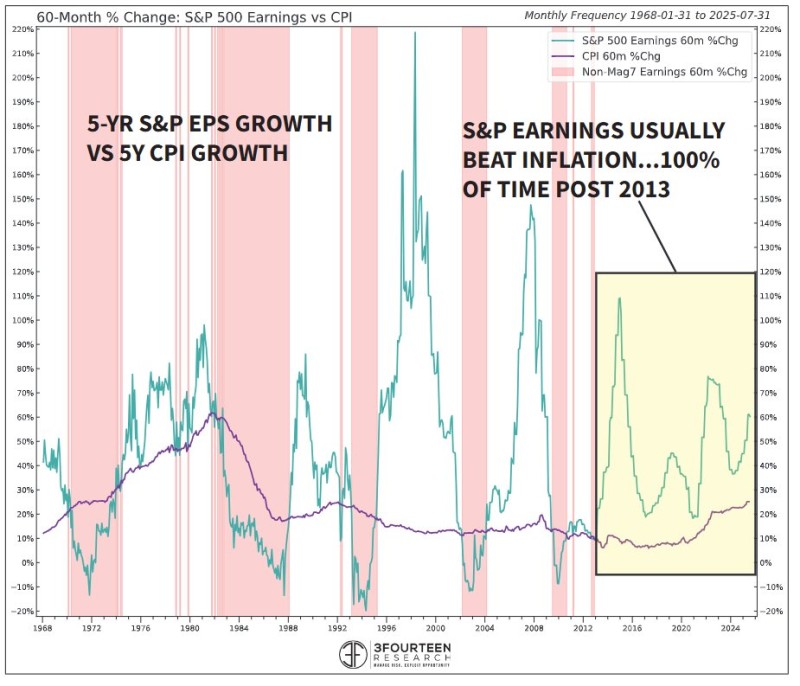

While inflation has been crushing household budgets and squeezing many businesses, America's biggest companies have been playing by different rules entirely. The S&P 500 hasn't just survived the inflationary storms of the past decade — it's thrived through them with remarkable consistency.

The Perfect Streak That Wall Street Can't Ignore

Since 2013, S&P 500 earnings have beaten inflation 100% of the time across all rolling five-year periods. That's not a typo — it's a clean sweep. Even looking back further to the post-2008 financial crisis era, large-cap earnings have outpaced consumer price index growth in 94.1% of all comparable periods.

This isn't just about good timing or lucky breaks. It reflects something deeper about how the biggest U.S. corporations operate in today's economy. They've built business models that don't just weather inflation — they actually use it as a tailwind.

The Secret Weapon: 20%+ Returns on Capital

Here's where things get interesting. S&P 500 companies are generating average returns on invested capital (ROIC) above 20%. That's not just healthy — it's exceptional. This level of profitability gives these firms something most businesses can only dream of: genuine pricing power.

When costs rise, these companies don't panic. They simply adjust their prices, and customers keep paying. That's the kind of market dominance that turns inflationary pressure into profit expansion rather than margin compression.

Why This Streak Could Continue

The combination of consistent earnings outperformance and rock-solid returns suggests this isn't a fluke that's about to end. These companies have demonstrated they can maintain their edge across different economic cycles, from the post-crisis recovery through various inflation spikes and market volatility.

For investors watching their purchasing power get eroded elsewhere, this track record offers something increasingly rare: a reliable hedge against the very forces that are making everything else more expensive.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah