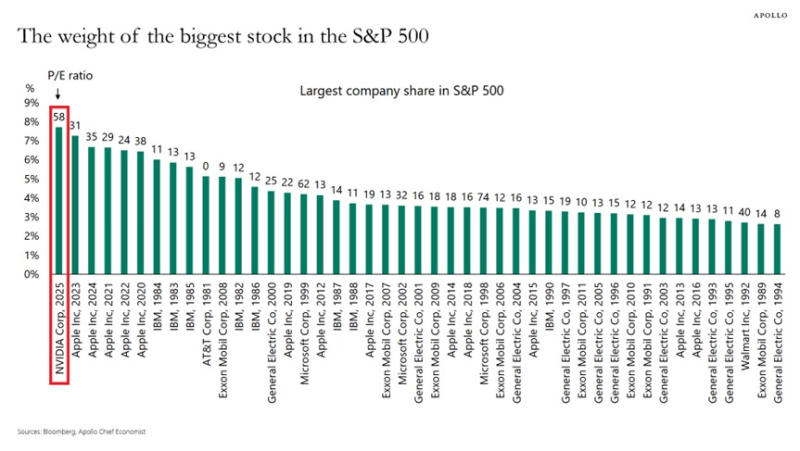

Nvidia's doing something that hasn't happened in four decades of stock market history. The AI chip giant now owns 8% of the S&P 500, crushing every previous record and leaving even Apple's 2023 peak of 7% in the dust.

Think about that for a second — one company is literally moving 8% of America's biggest stock index. Even during the crazy dot-com bubble when everyone was going nuts for tech stocks, Microsoft and General Electric only hit around 4% each. IBM's old record of 6% from 1984? Nvidia just steamrolled right through it.

NVDA Price Valuation Tells the Whole Story

Here's where it gets interesting — Nvidia's trading at a P/E ratio of 58, which is pretty wild compared to what we've seen from other market leaders. But here's the thing: investors are betting big on AI, and right now, Nvidia's basically the house that always wins in that casino.

Unlike the old days when the top dog had a more reasonable slice of the pie, Nvidia's massive influence means when it sneezes, the whole S&P 500 catches a cold. That's some serious market-moving power right there.

What This Means for Your Portfolio

So what's this mean for regular investors? Well, you're basically riding the Nvidia roller coaster whether you want to or not if you own any S&P 500 funds. When NVDA rockets up, it drags the whole index along for the ride. But flip side — when it tanks, it's taking everyone down with it.

Sure, plenty of smart money thinks Nvidia's AI dominance isn't going anywhere soon. But here's the reality check: no company stays king of the mountain forever. Even the biggest giants eventually get knocked down a peg or two.

The smart play? Don't put all your eggs in one basket, even if that basket is printing money right now.

Usman Salis

Usman Salis

Usman Salis

Usman Salis