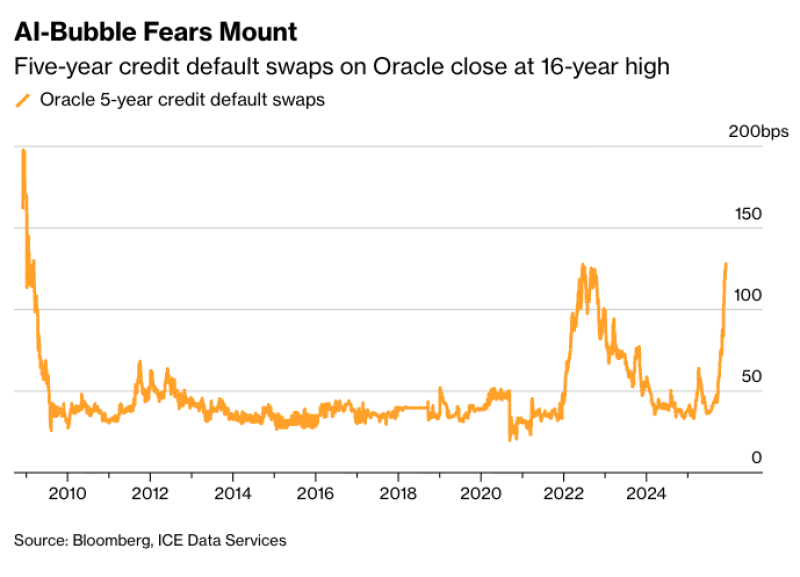

⬤ Oracle's credit risk is raising red flags across Wall Street. The cost of insuring the company's debt through five-year credit default swaps has climbed to around 1.28 percent annually — the highest level since 2009. This sharp increase shows traders are getting nervous about Oracle's ability to manage its growing debt pile as it races to build out AI infrastructure.

⬤ The company is now carrying roughly $105 billion in total debt after issuing $18 billion in bonds earlier this year. Trading volumes for Oracle's credit protection have surged to nearly $5 billion, reflecting just how much attention the market is paying to these risks. The speed of this repricing suggests real concerns about whether Oracle can keep up with rising borrowing costs while funding its ambitious expansion plans.

⬤ What makes this situation stand out is the context. Oracle's credit spreads stayed relatively calm for over a decade, but now they've shot past the spikes we saw during the 2020 pandemic panic and the 2022 market selloff. This is happening as questions swirl about whether the AI buildout has gotten ahead of itself, with companies taking on massive debt to grab market share in cloud computing and data center expansion.

⬤ These rising insurance costs matter because they're a live signal of how the market views Oracle's financial health. When protection gets more expensive, it can make future borrowing harder and more costly, potentially slowing down growth plans. With Oracle now facing its priciest credit insurance since the financial crisis, investors will be watching to see if this is just a temporary scare or the start of something more serious.

Peter Smith

Peter Smith

Peter Smith

Peter Smith