NVIDIA shares are showing early weakness today, slipping over 1% before the opening bell as traders react to growing volatility in the tech sector. The move reflects cooling short-term momentum after several sharp intraday swings, setting a cautious tone for the trading day ahead.

NVIDIA (NVDA) is currently trading at $184.40, down $2.46 (–1.32%) in the pre-market. The decline points to softening sentiment in one of the market's most influential AI and semiconductor stocks.

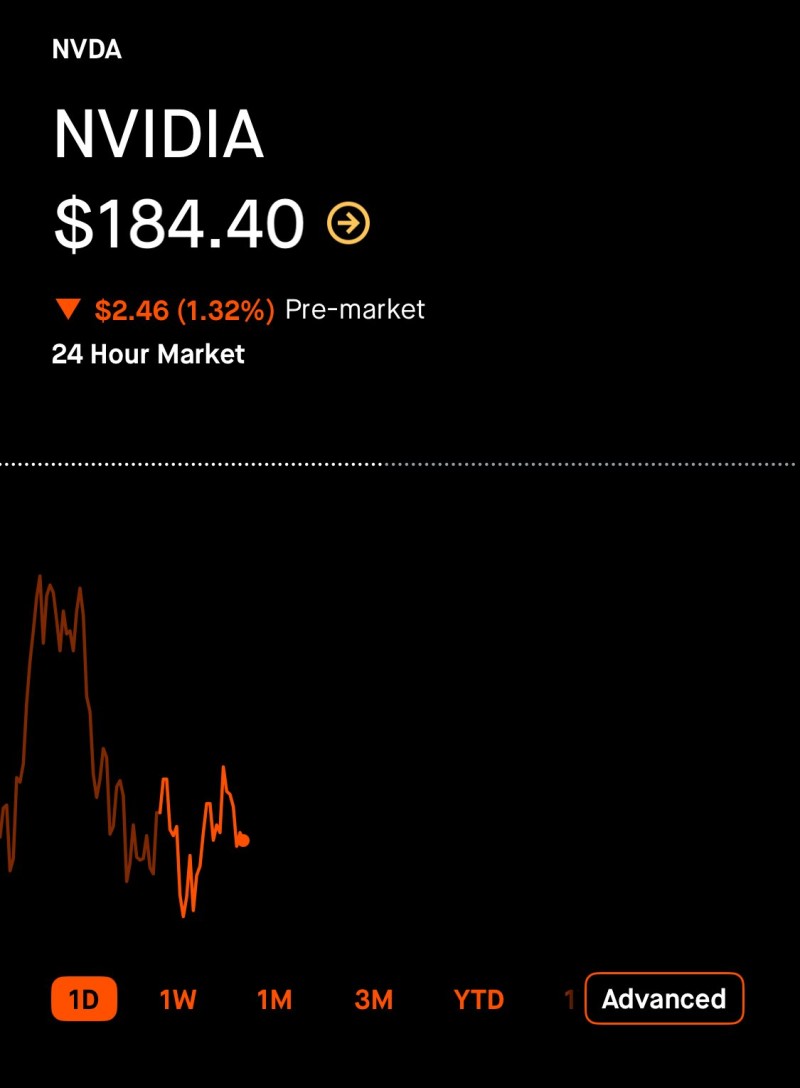

Chart Analysis: NVDA Shows Increasing Intraday Instability

The attached chart reveals a jagged intraday pattern, with NVDA moving sharply lower before attempting several unstable rebounds. This reflects heightened uncertainty, where neither buyers nor sellers maintain sustained control. While specific support or resistance levels aren't explicitly shown, the overall structure indicates fading momentum. Each recovery attempt appears weaker, suggesting sellers are pressing the stock lower during early trading hours.

The chart's orange line — representing the 1-day view — aligns with the pre-market quote of $184.40. The combined visual and price data show a weakening tone that supports the observation of a pre-market decline. Since the chart only displays immediate intraday action without broader levels, no specific long-term support zones are visible. However, the price trajectory suggests traders may soon look for stabilization points if weakness extends into the opening session.

What's Driving NVDA Lower Today?

Several broader factors may be contributing to NVIDIA's early decline:

- Tech market softness has emerged as high-valuation tech stocks have cooled after recent volatility

- AI sentiment moderation is taking hold after a long AI-driven rally, with traders potentially rotating into safer assets

- Macro uncertainty continues as interest-rate expectations, bond-yield movements, and risk-off flows weigh on growth names

- Short-term profit-taking has kicked in, as fast intraday drops often trigger additional selling from momentum traders

Together, these forces create a challenging environment for high-beta stocks like NVIDIA.

Will NVDA Stabilize or Extend Its Pullback?

NVIDIA remains a dominant force in AI infrastructure and GPU demand, but its short-term price action suggests a phase of consolidation. If the stock finds support after the opening bell, a rebound could develop later in the session. However, continued pressure may push NVDA into deeper near-term volatility. Long-term fundamentals remain strong, but near-term caution appears justified.

Peter Smith

Peter Smith

Peter Smith

Peter Smith